International diversification is necessary

Macro Real Estate AG is a strong advocate of the idea of international diversification in real estate portfolios. Looking only at the returns achieved, this strategy might not always have paid off during the low inflation phase of the last 15 years. In most countries, very high returns were achieved with local real estate portfolios. Our approach to investments is always to consider the risks, even if they do not materialize. It is about constructing an internationally diversified portfolio that is resilient to local shocks and invested in sectors that benefited from structural trends (macro research-based investing). Germany and Sweden, two darlings of investors in the last decade, are two examples of countries abruptly hit by local shocks in 2022. Distress in the real estate markets in these two countries is likely to increase in 2023.

We expect that in the new macroeconomic landscape, such negative events on the portfolio will happen more frequently. Even in Switzerland, we expect devaluations in 2023 and 2024. Therefore, we would advise investors to go global in their real estate portfolios.

Indirect approach with focus on non-listed real estate assets

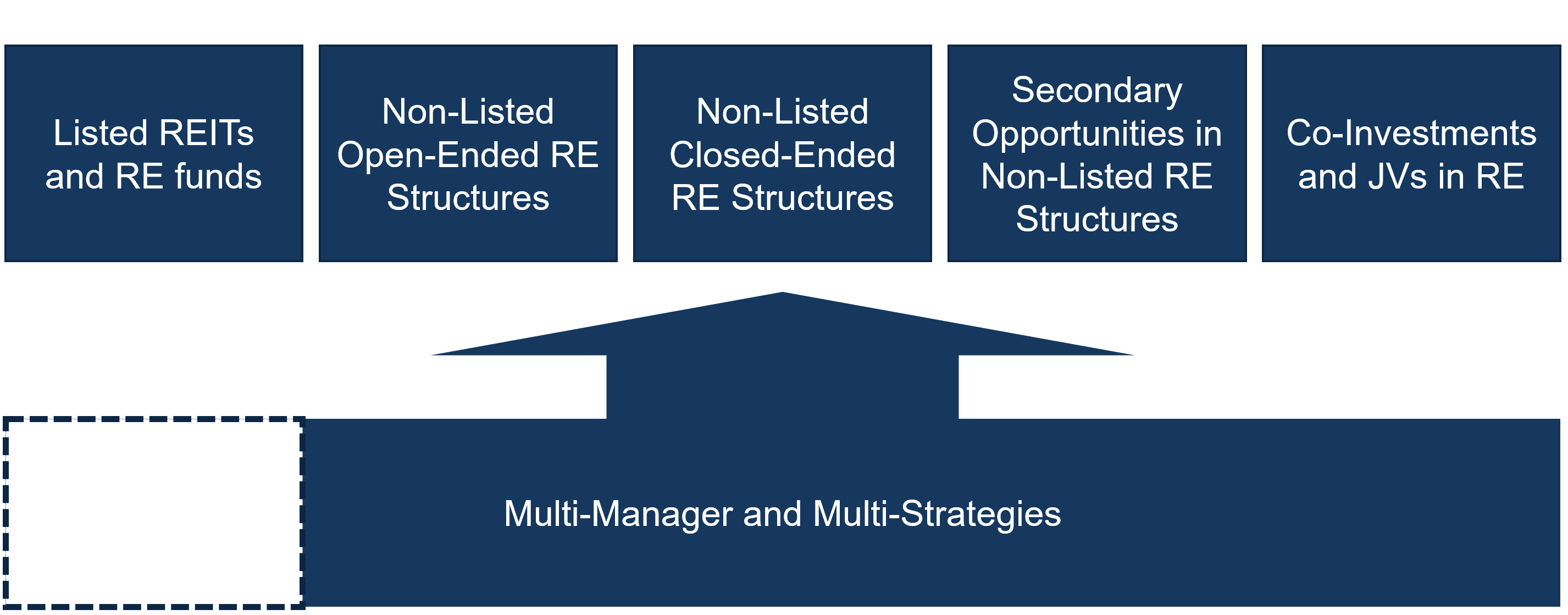

Investors who do not have the financial capacity to build a direct international portfolio are well advised to invest indirectly. Most institutional investors belong to this group; for we assume that minimum investments of more than USD 2 billion are necessary to create a diversified global portfolio. Figure 1 shows the various building blocks for establishing indirect international real estate exposure:

Figure 1: Types of indirect real estate investment vehicles

Retail investors are often restricted to listed markets due to regulations. The values in listed RE corrected significantly last year. Institutional investors tend to focus on “private markets,” the four remaining categories. Open-end real estate funds typically offer quarterly or semi-annual liquidity (some even monthly) and are primarily invested in core real estate strategies. Closed-end funds typically have a higher risk appetite and are invested in value-added or opportunistic strategies. Secondaries or co-investments are other means of investment. Both of the latter strategies can generate significant alpha but require a higher degree of sophistication on the part of investors. Those investors who are overwhelmed by the manifold possibilities or cannot handle it resource-wise can invest via multi-managers. Certainly, by going down this route, the investor lose some control but delegates managerial and strategic selection to a team of subject matter experts.

The redemption wave in open-ended structures has started in H2 2022

Open-ended real estate funds of various natures exist. Typical of such structures is that the investor trades with the fund manager and draws his share at NAV and, depending on the redemption policies, can redeem daily, monthly, quarterly, semi-annually or annually.

Historically, German open-ended real estate funds for retail investors already provided negative experiences during the financial crisis. UK open-ended funds (also predominantly a retail product, although many UK pension funds are invested in such) have been in the headlines in recent years due to high redemption volumes at each crisis. Examples include the weeks after Brexit vote, Covid crisis and the UK pension funds crisis last October.

Following the bailout of UK pension funds by the Bank of England last fall, many UK investors have increased their cash ratios. UK open-ended real estate funds then received a large number of redemption requests. As a result, most such funds have halted the redemptions of their fund’s shares.

When we talk about a redemption wave in open-end structures, we do not specifically mean such products for retail investors, but institutional open-ended real estate funds, such as Luxembourg structures or U.S. open-end diversified real estate funds or “Private REITS”.

The information on such products is non-public. We are fortunately strongly networked in the indirect real estate market in Europe, the USA and Asia and monitor the sector. As a result, we have already learned of significant redemptions of such structures for Q3 2022, particularly in the USA and Europe and Asia.

We currently see four factors as decisive for the redemption wave that is heading our way:

- Investors’ need for liquidity in a crisis. Open-ended real estate funds offer liquidity over closed-ended funds or direct investments. In a crisis, usually liquid products are always sold first, often regardless of their performance.

- “Denominator effect” and rebalancing: 2022 was one of the weakest years for bonds globally. Stock portfolios also suffered heavy losses. As real estate valuations have so far remained relatively stable, this has led to an increase in real estate quotas in the investment portfolios, in some cases above the “asset allocation limits”. A rebalancing away from real estate to other investments has started accordingly.

- Higher fixed income yields and hedging costs: Two-year EUR and USD government bonds currently offer similar or higher distribution yields than some core real estate funds. This leads to a decrease in the relative attractiveness of real estate. Also, hedging costs have increased due to larger interest rate differentials between currencies and can be a factor, such as for CHF investors.

- Devaluation expectations and delayed valuation adjustments: Most open-ended real estate funds have hardly devalued their portfolios until Q3 2022. In contrast, the development of net yields in transaction markets and listed REITs show that devaluations averaging at least 20%-30% could be imminent globally.

Investors anticipating such an evolution and whose redemptions are honored by the fund manager can walk out at higher NAVs. Considering the powerful investment performance from 2021, they can exit at high profits. This works only if their exit can be realized before funds restrict redemptions. In the case of delayed redemptions, they may even face the worst-case situation of getting their shares back at the market trough.

As a result of the redemptions requests received, some such products have already temporarily restricted the ability to return shares. Q4 2022 information has yet to be made available. We assume that the redemptions will increase. From the perspective of existing investors, it makes sense for the fund manager to limit redemptions in such a case, otherwise, properties will have to be sold at “fire sale” prices. We would therefore expect some news on redemption freezes in the coming weeks. This is probably getting batted around in the press and bringing adverse headline risks for some investment managers.

Difficult H1 2023 expected for real estate capital markets

Many such funds will limit redemptions and not do “fire sales.” Nevertheless, they will try to increase their cash quotas and thus appear on the selling side. We have seen some transactions in 2022 where open-ended real estate funds were sellers. Some were even completed at capitalization rates 150 bps higher than 2021. At the same time, the economic climate is deteriorating. A recession in the USA and Europe is considered likely and is likely to turn the still favorable rental market situation into a negative one. Consequently, we expect NAV per units to decline for most open-end real estate funds in the coming quarters. Capital raising for real estate investments will remain challenging in such an environment.

The 2019-2021 vintages of closed-end funds are also likely to face challenges in some countries, as the exit cap rates and financing costs (if not fixed) assumed in the models at the time will turn out to be significantly too low. But it is an estimate to be made depending on the fund and also depends on how aggressively it deployed the capital at that time. Other funds that are in sectors that are currently benefiting from positive demand trends (such as Hospitality, Alternative Real Estate) should continue to generate solid performance.

However, such an environment does not only lead to losers but also reveals opportunities. Here we elaborate some more thoughts

Value Opportunity I: 2022/2023 Vintage Opportunistic/ Value Added Funds or Co-Investments

Our assessment is that transaction markets are reacting faster than valuation markets. This means that buy-side strategies can take advantage of opportunities earlier than valuation-based strategies from existing portfolios. Consequently, the focus here is likely on value-added and opportunistic strategies that have already raised capital or are in the process of “capital raising” but have not yet invested their capital.

In the past, it was essential to present an exclusive deal pipeline to potential investors during fundraising. Now, patience and prudent management, which is not oriented to fees but is incentivized by success, are the virtues in demand. But manager selection and the ability of managers to “execute” in those sectors that benefit from structural trends remains critical. You can’t blindly run into any value added or opportunistic funds.

Value Opportunity II: Secondaries (at substantial discounts)

The high liquidity needs of some investors offer investors the opportunity to act here as buyers of funds or co-investments in secondary market transactions. These can be open-ended structures or closed-end funds from the 2018-2020 Vintages. The decisive factor is the discount at which current investors are prepared to sell their shares. Analytical skills and a good assessment of the portfolio and financing (J-curve effects must be taken into account) are required here. Often, the funds that trade at the largest discounts are not the ones that offer the most fantastic opportunity. Here, it is essential to form a research-based forward-looking view on the vehicle and its investment themes.

Open ended structures: Difficult decisions by investment managers

Like Value Opportunity I, we see newly launched open-ended real estate funds that have not yet invested their capital as transaction-based opportunities. However, most of the open-ended funds do not belong to this category.

The countercyclical opportunity offered by existing open-ended funds to new investors depends on their devaluation policy. This is a double-edged sword. If you devalue properties too aggressively, you scare off existing investors and signal that something may be amiss. This may prove too counterproductive, primarily if peers pursue a different policy.

A too timid devaluation policy makes funds unattractive for new investors. In this environment, it is also worth noting that valuation practices and mentality play a large role in how quickly valuations are adjusted to new market levels. The rather mark-to-market philosophy in Anglo-Saxon countries suggests that opportunities for open-ended real estate structures will occur first in these countries (USA, Canada, UK, Australia). However, this is only one factor that must be considered with several other factors when selecting funds.

Setting the course for outperformance in the next cycle

Patience is still required at the moment. As an indirect investor who invests new money and pursues Value Opportunity I, there is no downside to waiting out the first few months of the year. The 2023 Vintage funds will still be open at the end of the year. We live in a time of high uncertainty, and various compelling opportunities will reveal themselves depending on further developments, which are currently impossible to anticipate.

Investment managers pursuing value Opportunity I and investors pursuing Value Opportunity II have a critical year ahead. Active monitoring and dealmaking will be essential in 2023. It was precisely in the period of the greatest crises that the best deals were born.

As always, we would like to say that this article is not an investment recommendation. Much detailed analysis is necessary for an investment and investment strategy. Macro Real Estate is also here in 2023 for investors and investment managers to hopefully make the right decisions via a research-based approach. 2022 was a transition year for real estate markets. 2023, on the other hand, will be a critical year. Decisions this year will set the course for investors as well as investment managers to outperform or underperform peers in the next cycle.

Leave A Comment