We compare the performance of Swiss and international NAV-based core real estate investments. In recent years, investments in Switzerland have substantially outperformed international ones. Nevertheless, it is currently worth taking a look abroad. In the past, major corrections in international real estate prices, such as those currently being observed, have often been a good time to increase international real estate quotas.

Here we would like to provide an overview of the development of NAV-based real estate investments in Switzerland and abroad. The focus of this article is on core real estate products with semi-open structures. With such investments, investors achieve their returns through distributions and changes in the valuation of the investment portfolios. (Value added and opportunistic strategies are covered in a separate article)

Unfortunately, such products are only available to institutional investors. In Switzerland, such investments are primarily the real estate investment foundations that pension funds use for indirect real estate investments. However, there are also some real estate funds that are not listed on the stock exchange. Abroad, we are typically familiar with unlisted open-ended diversified real estate funds. Such vehicles exist in the USA, Europe and Asia-Pacific. These are very comparable with Swiss investment foundations in terms of leverage (typically less than 25%) and the core strategy pursued. Such vehicles are also only accessible to institutional investors and should be distinguished from the open-ended German and British real estate funds for private investors, which are often mentioned negatively in the media.

Real estate investment in the USA vs. Switzerland since the end of 1998

With an international investment, it is essential to take currency developments into account. Due to the lower level of interest rates in Switzerland compared to other countries, Swiss investors who invest in international vehicles incur costs for hedging foreign currencies. Alternatively, it is possible to accept a foreign currency risk.

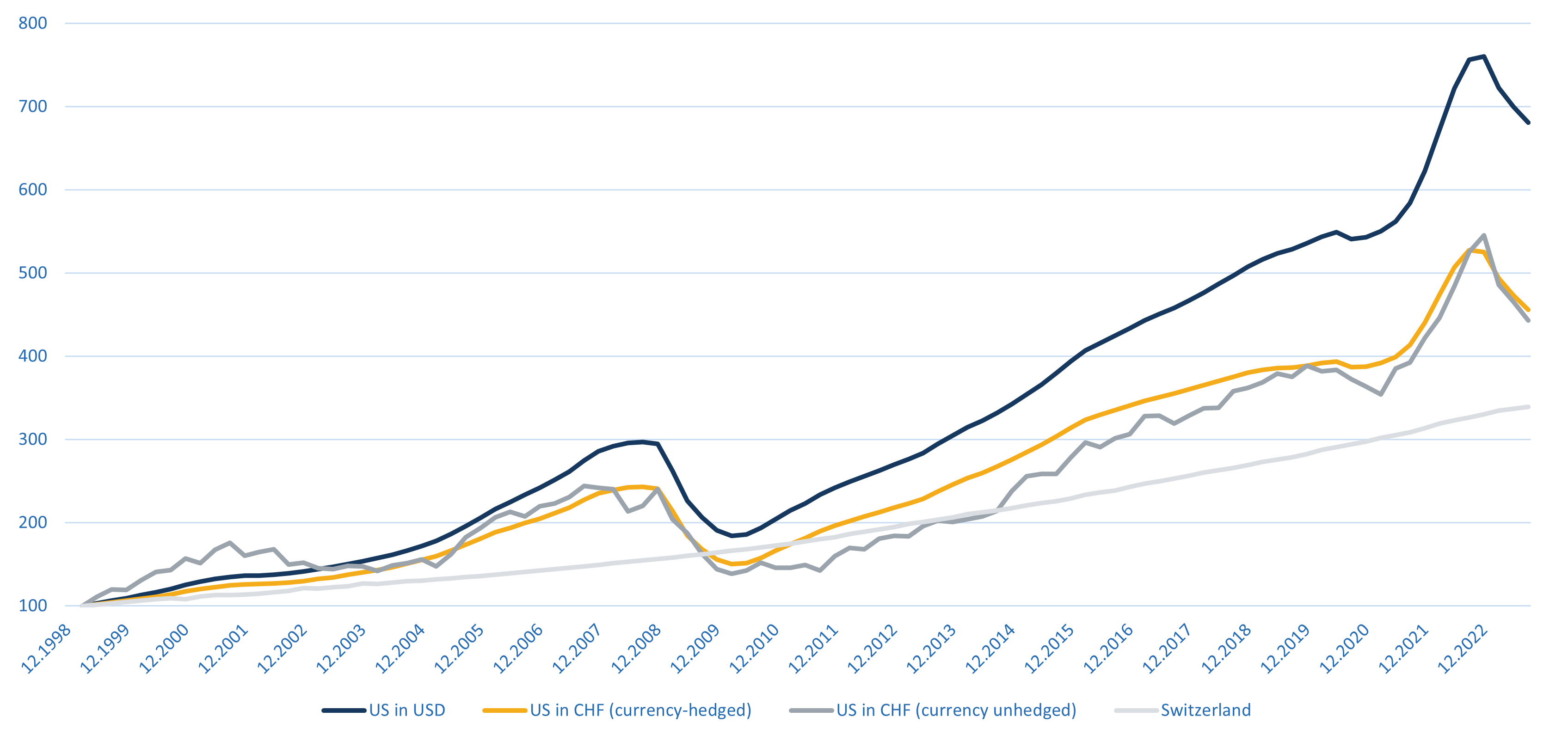

Figure 1 shows the development of total returns of KGAST (i.e. Swiss real estate investment foundations) compared to those of open-ended, diversified US real estate funds (ODCE) over the last 25 years. A 10 million Swiss franc investment in a portfolio of investment foundations that reflects the KGAST would have a value of 34 million at the end of 1998 with the reinvested distributions. US core real estate in local currency would have achieved about double that. After deducting the costs of currency hedging or CHF appreciation, such a portfolio would currently stand at CHF 44 million.

Figure 1: Comparison of indirect NAV-based core real estate investments (total returns indexed as of Q4 1998=100)

Source: Bloomberg, Macro Real Estate

The fact that the currency-hedged portfolio performed similarly to the unhedged portfolio over this period is a coincidental result. This is due to a stronger USD performance in recent years. The situation is different for investments in GBP and EUR, as these currencies have depreciated more strongly against the CHF. Accordingly, from a Swiss franc perspective, we prefer to hedge the currency for international real estate investments, as we also expect the CHF to strengthen in the medium and long term.

Out- vs. underperformance Switzerland vs. abroad

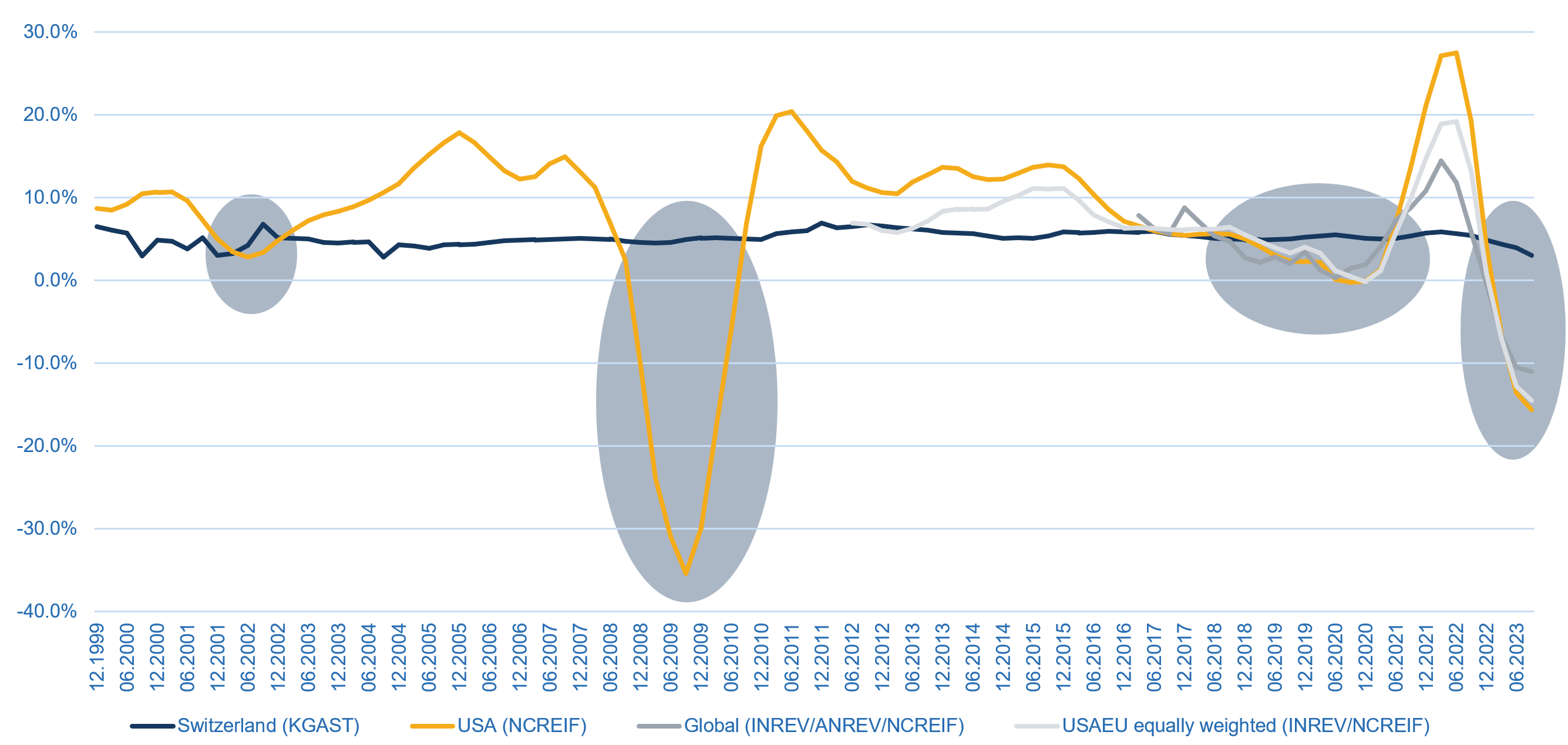

We have chosen the long-term comparison with the USA due to the availability of data. In Figure 2, we have calculated the performance of alternative indices after hedging the currency exposures in CHF. We show the index calculated by INREV/ANREV/NCREIF for institutional open-ended diversified real estate funds. In addition, we have also calculated an equally weighted European and US index based on the total returns of US and European open-ended diversified real estate funds.

Figure 2: Year-on-year change in total returns (all international indices in CHF after taking into account the costs of currency hedging)

Source: Bloomberg, INREV, ANREV, NCREIF, Macro Real Estate

Fig. 2 illustrates that the international indices outperform Swiss investments over a long period of time. However, their volatility is also significantly higher. This is due to the fact that values abroad fall more sharply in a crisis than those of Swiss real estate. We have shaded four such periods. These were periods of major shocks such as 9/11, the financial crisis, the coronavirus crisis and the current inflation shock.

In Table 3 we have calculated the annualized total returns achieved for the indices under consideration for various periods. The last five years in particular have been rather lean for international real estate investments. With the exception of the strong rebound in 2021, international investments underperformed Switzerland over this period.

Table 1: Total returns of indirect NAV-based core real estate investments in Swiss francs (currency-hedged)

| Switzerland | USA | US-EU | Global | |

|---|---|---|---|---|

| p.a. since the end of 1999 | 4.9% | 6.0% | N.A. | N.A. |

| Since Q2 2011 p.a. | 5.3% | 7.1% | 5.2% | N.A. |

| the last 5 years p.a. | 4.7% | 3.1% | 1.9% | 1.1% |

| Cumulative since Q2 2022 | 4.3% | -16.1% | -15.4% | -14.1% |

Source: Bloomberg, INREV, ANREV, NCREIF, Macro Real Estate

Five consecutive negative quarters since mid-2022

The quarterly performance of international indices in Swiss francs has now been negative for five consecutive quarters. The last quarter of positive quarterly performance in CHF was Q2 2022. This corresponds to a cumulative negative total return of these three indices of between -14.1% and -16.1%. Swiss real estate investments outperformed the global index by 18.4% over these five quarters. This outperformance was achieved despite a significant weakening for Switzerland. For Swiss real estate investments, 2023 is likely to be the weakest year since the crisis in the 1990s. As at the end of November 2023, the total return of KGAST was 2.5% compared to a year ago; we expect it to fall below +1% for the full year 2023 with the year-end valuations.

Courage needed to increase international real estate quotas

Despite the current gloomy mood, Swiss real estate investments have performed their role in portfolios well even in the current period of weakness. They continued to hold their value even in this environment and provided downside protection.

However, the decision to invest capital should be made with foresight. The correction in the wake of the financial crisis in the USA was a cumulative -45% in CHF terms (i.e. much deeper correction), but only lasted for six consecutive quarters. As a large number of open-ended US real estate funds are still struggling with significant redemptions, the “underperformance” of diversified international funds is likely to continue into next year. As we have seen, the phase of lower total returns on international investments compared with Switzerland has already lasted around five years. However, as we have also illustrated in Figure 2, such a significant correction is usually followed by a phase of relative outperformance for international investments.

Decision-makers have a choice. If you only want to passively manage your real estate quotas, then an investment purely in Switzerland is the right choice, as fluctuations are likely to remain limited here. However, we believe that Swiss core investments are unlikely to perform as strongly as they did during the negative interest rate phase. We believe it is realistic to expect that global investments will again outperform Swiss investments significantly over the next three years. This is why courage is now also required from decision-makers. We recommend thinking about increasing the international quotas today and implementing them in the course of 2024.

Positive or negative alpha during implementation

The correction in values abroad has already led to interesting valuation levels for various funds, particularly in the logistics and residential sectors in Europe. As an example, we are looking at open-ended European core logistics real estate funds with current net yields of 5.5% (based on portfolio valuation) combined with conservatively calculated potential for net income growth of 4%-5% p.a. over the next three years to be exciting.

The implementation of international real estate allocation is also crucial. We have seen global multi-manager real estate products deliver significant alpha versus the indices listed above over the last five years. Unfortunately, various investors have invested in single-sector or country vehicles whose performance is significantly below that of our indices. A research-based approach and manager and thematic selection skills will remain key prerequisites for generating alpha in international real estate investments in the future.

Disclaimer: This is not an investment recommendation, but merely an expression of opinion. A much more detailed analysis than this short article is required for the investment. Macro Real Estate can support investors and investment managers in the analysis of Swiss and international real estate markets and investments.

Leave A Comment