Photo source: Messe München

This week the Expo, the largest and most important real estate conference in Europe, took place again. Was it the Oktoberfest beer or the community? The mood was lifted for most of the participants. This despite a year that was one to forget for many investors and investment managers….

For those who have never attended the conference, it should be noted: it is extremely valuable to attend such a conference. From developers to bankers, cities, brokers, evaluators, placement agents and investors from around the world, a wide range of attendees were represented.

We take home the following takeaways enriched with our Views:

- Despite the good mood, the situation remains challenging. Very few deals continue to be concluded worldwide, as seller and buyer expectations are still far apart. While there are sporadic signs that sellers are now accepting lower prices, volumes have remained very thin.

- Those who now expect a substantial increase in transactions in Q4 2023 will likely be disappointed. Many investors will continue to wait and see. Both equity and debt investors remain on the sidelines in view of the uncertainties. Few investors will make subscriptions to funds this year. Nevertheless, slightly more transactions are likely to be realized than in previous months.

- The German real estate market is in its biggest crisis in several decades. Construction projects are currently the most challenging segment, as values here are burdened not only by lower exit prices, but also by a 25%-30% increase in construction costs. Many projects that were planned are put on hold under these circumstances. The problem is: if exit prices fall even further, even fewer construction projects will be made. The market for construction projects is therefore likely to take years to become attractive again. This would require significantly lower construction costs and higher exit prices.

- The existing property market is likely to regain its equilibrium more quickly. However, distressed sellers are still in short supply in both Europe and the USA.

- We continue to find price levels for commercial real estate and residential investment properties in the US too high, and yields too low. Given the rise in government bond yields, another correction should be coming. The fact that the US economy is weakening more slowly than we too expected is one reason. A recession, which we continue to see as only postponed, should be the key to more attractive real estate valuations in the US. Our discussions did not reveal any significant improvement in ratings since our mid-year USA business trip.

- We believe that currently for the investment of new capital Scandinavia is worth a look. This is where the ratings have corrected the most so far. Refinancing problems force owners to accept lower prices. Relatively in Europe, we are also bullish on Spain. They have done their homework macroeconomically and see this country as more stable than Germany, France, the UK or Italy despite the current risks.

- We remain cautious on the UK. On the positive side, valuations here have already corrected more strongly last year. Other structural problems, such as the shortage of skilled labor, suggest that economic growth is still likely to lag here. Inflation has finally come down, but financing costs are above the levels of net yields in virtually all segments. Relatively, we prefer residential (build-to-rent) or student housing here, which is structurally in an undersupply. Logistics is also exciting due to corrected yields. But we would continue to look at the UK only selectively and underweight it in portfolios. We are not convinced by the medium-term prospects.

- Asia: We met some Asian managers. Korea is probably the office market worldwide with the best rental market situation at present. Here, vacancy rates are low. Singapore is also working well due to the fact that Kong Kong is no longer a competitor and many are moving their Asia hubs to Singapore. However, the market is already quite expensive for all segments. Unlike many investment managers, we see high valuation risks in Japan, which could materialize in the next few years. Many investors underestimate that rising interest rates also pose a threat to real estate in Japan. We are constructive on investments in Australia. Values are correcting and attractive entry opportunities are likely to open up. Emerging Asia remains a promise, but investment products are scarce here.

- By and large, we are strategically positive on Asia. Politically and geopolitically, Europe is likely to face a difficult decade. Therefore, we recommend to hold a part of the assets outside Europe. Many European institutional investors are still under-allocated to Asia in their portfolios.

- Cracks are also widening in the Swiss real estate market. Our discussions confirmed the difficult situation on the Swiss capital market. A large volume of investment properties, unprecedented since the 1990s, is currently for sale. In Switzerland, sellers seem even less willing to accept lower prices than abroad. One problem is that despite the interest rate increase of more than 100 basis points (in real terms), valuers are using the same and in some cases lower discount rates as during the negative interest rate phase (see our paper). The too high ratings are a problem for some potential sellers. As some have to sell, they will inevitably have to accept lower prices sooner or later and valuations will continue to fall successively. However, this process is unlikely to be completed before 2025. Therefore, Swiss real estate investments are likely to underperform globally for the next few years. Investors would therefore do well to have international real estate assets in their portfolios. However, we would currently recommend this not through NAV-based strategies but through vehicles that are currently buying and modernizing (closed-ended structures).

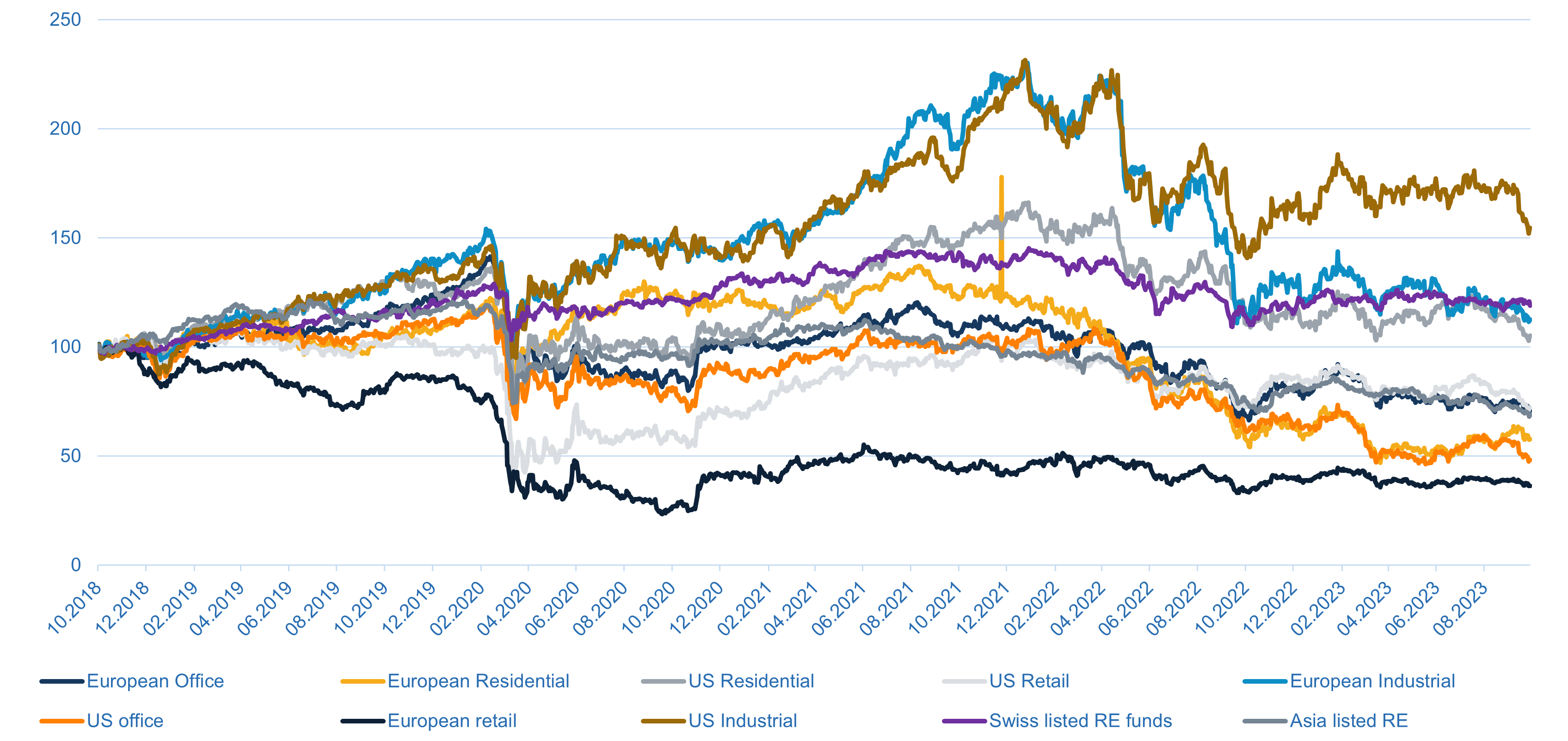

- The recent rise in yields on government bonds worldwide (driven by the U.S.) has led to renewed downward pressure on the prices of listed real estate assets. The following figure shows the development of prices for different sectors over the last 4 years. We will write a special post on this in the coming weeks ; We would like to preface that we are about to become more optimistic now for listed real estate, especially for various European and Asian sectors. The recent correction in US logistics REITs should also be noted, as this sector continues to have the strongest outlook in terms of cash flow growth

Figure 1: Prices of listed real estate assets

Source: Bloomberg, Macro Real Estate, in local currencies (except Asia Index in USD)

Leave A Comment