Real estate investors usually focus on real estate performance, building plans, or architectural beauty. Financial engineering is not considered a core competence and is sometimes even regarded by many as evil. We couldn’t disagree more. International real estate investors ignore FX risks at their peril. This especially applies when dealing with a hard currency such as the CHF.

Core investors that invest internationally still look at what the investments can deliver in their home currencies. FX risk is usually hedged for core strategies. What most investors underestimate is that hedging can have effects on returns in both ways. Coming from a higher interest rate currency and investing in a lower interest rate currency, an additional yield can be harvested by neutralizing FX risks. Is the investor’s home base a low-yielding currency, FX hedging is a drag on returns. So, in the end, international real estate investors who need to hedge, should monitor interest rate differentials and account for them in their investment considerations.

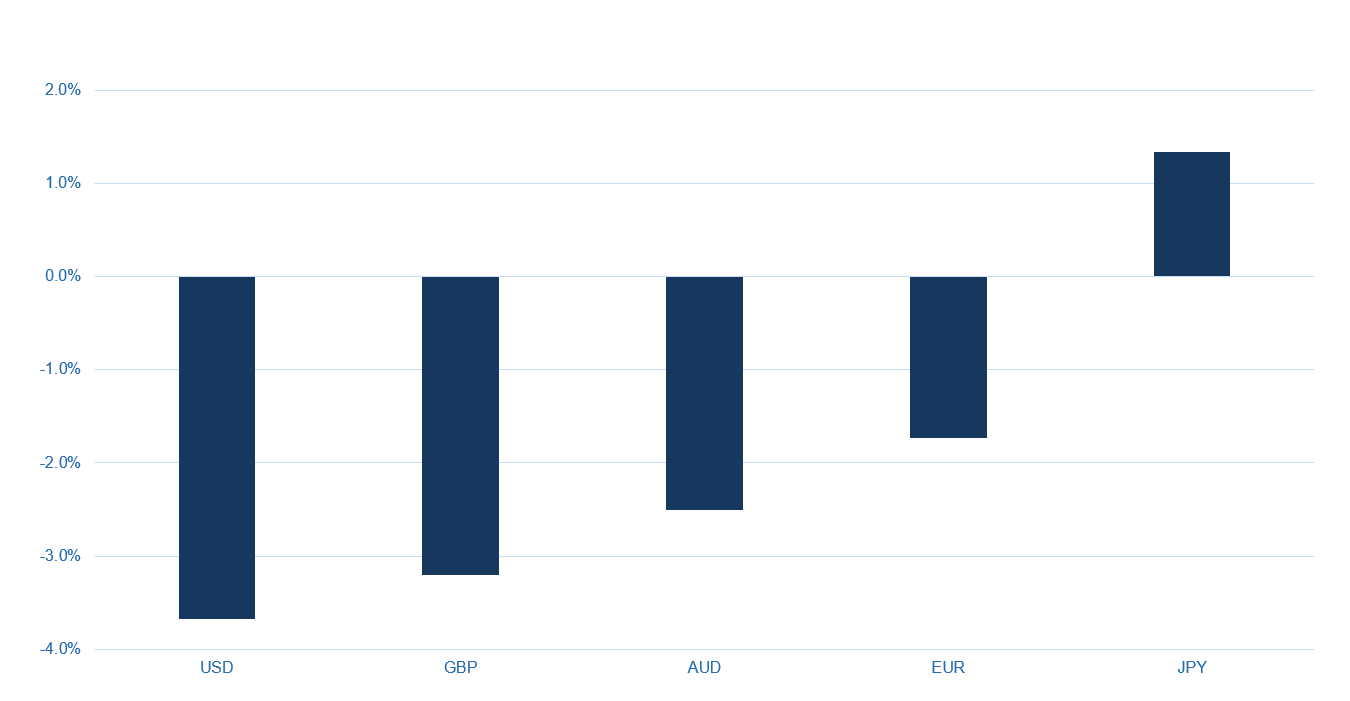

2022 has been a hell of a year regarding the shifts of interest rate differentials due to varied inflationary pressures by country and central banking reactions. Figure 1 shows that having CHF as a home currency currently comes with challenging hedging costs when investing internationally. We estimate that hedging the USD is the most costly with annual hedging costs of 3.7%. Last year these costs were still below 1%. The current estimated hedging costs vs. the EUR were the previous year at 30bps, while we are now at over 1.7%. This is all due to the more aggressive rate hikes outside of Switzerland in response to higher inflationary pressure. Japan has been the big exception even as we saw this week some shifts of BOJ MMT policies. CHF investors now earn a positive currency return of more than 1.3% when hedging JPY risks.

Figure 1: Estimated current one year hedging returns from CHF home currency perspective (per 21 Dec 2022)

Source: Bloomberg, Macro Real Estate AG

But what does that mean for real estate investments? One needs to put the hedging costs into the context of the real estate yields, IRRs, and total returns. Currency volatilities have a bigger impact on lower-risk core strategies due to lower volatilities and returns with such investments. So more conservative investors should even focus on a higher degree on FX-hedged returns than value-added or opportunistic investors.

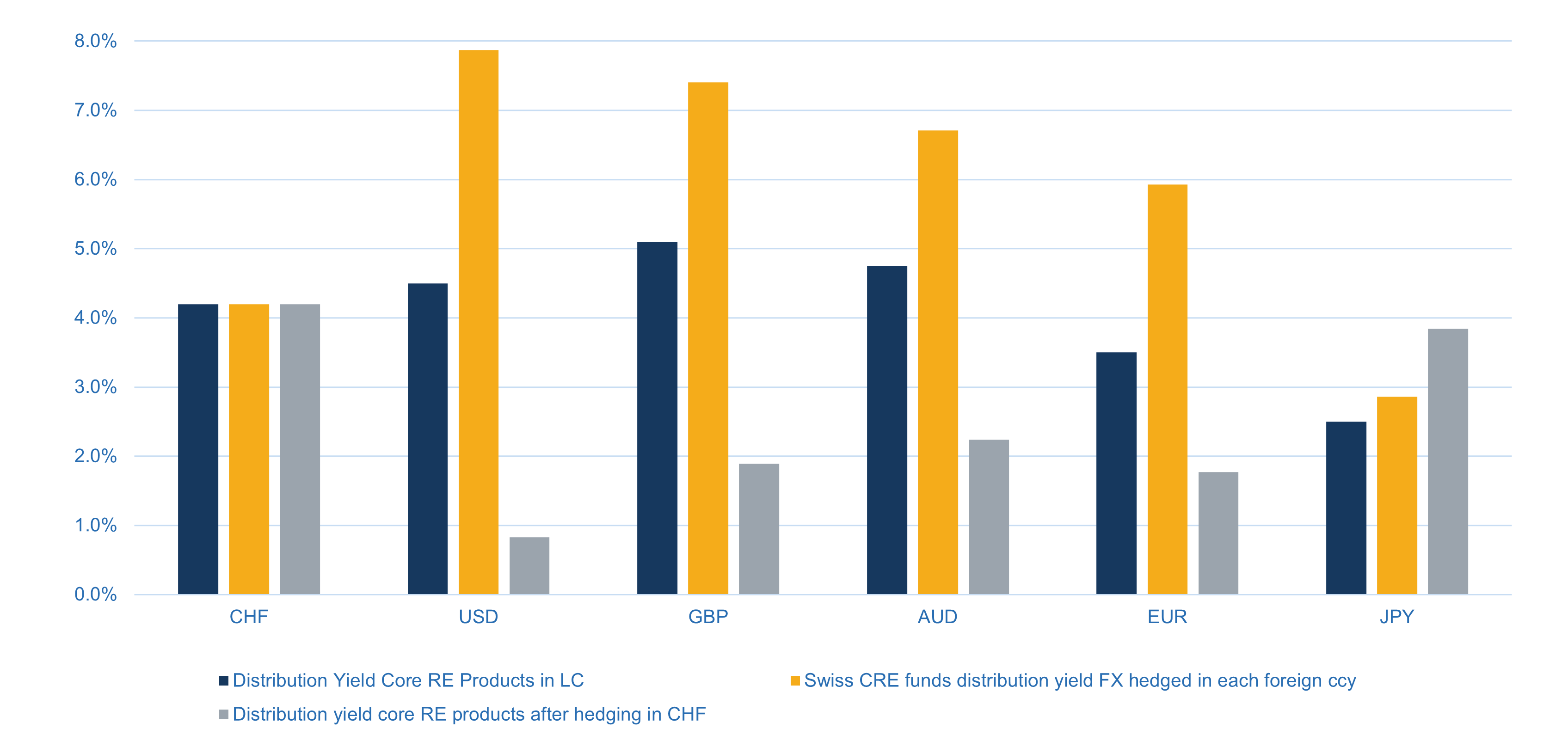

In figure 2 we have compared distribution yields that we observe for core listed and unlisted real estate products in both ways. We look at what is the after-hedging distribution yield from CHF perspective when investing in international real estate markets. But we also look at something that a very limited amount of investors have considered so far. Investing into Swiss real estate and hedging back the currency to USD, GBP, or other currencies.

Figure 2: Core real estate product distribution yields from FX and CHF perspective

Source: Bloomberg, Macro Real Estate AG

From the CHF home currency perspective hedging costs currently eat a large part of the distributions yields away when investing in international real estate. This is because real estate valuations and distribution yields have not adjusted yet, while interest rates jumped in currencies such as the USD by 450 bps this year.

By investing in US core real estate funds (unlisted) investors are getting more or less a similar distribution yield in local currency like with Swiss CRE funds. This comparison is somewhat unfair, because Swiss real estate funds trade at a discount. And we are comparing them with NAV-based products. But still, these are the common instruments that institutional investors are using for getting exposure to Swiss or US CRE indirectly. Of course, listed REITs have a higher dividend yield but I to use prefer nonlisted RE as a proxy for international institutional RE exposure rather than listed REITs that are rather for retail investors.

Swiss real estate distribution yields interesting from FX view

Investors who are thinking in USD, GBP, AUD (KRW as well…), or even EUR terms however find rather high FX-hedged distribution yields in Swiss commercial real estate. Some Swiss real estate funds could achieve an 8% distribution yield in USD and still around 6% in EUR terms in 2023. What could go wrong?

- These distribution yields are based on past dividends. These are annual dividends. For the most part, we think it’s highly likely that these dividends can be sustained, but some might struggle due to higher debt costs.

- These are commercial real estate funds. The “Lex Koller” regulation however that restricts investments into Swiss residential real estate to Swiss residents So this is also not an issue when considering Swiss CRE investments.

- Hedging for one year can also be fixed. There is no uncertainty about that. If I sell CHF one year forward vs USD, I can lock in my exit. That certainly doesn’t work when considering rolling, as interest rate differentials and thus hedging costs can change. Real estate investors can also fix it for longer terms. Then the annual hedging returns are lower as over time markets expect these high-interest rate differentials to normalize. But they are still significantly positive on a 5y horizon.

- Banks’ margins and opportunity costs don’t weigh as much, and institutional investors can also manage that.

- An issue is certainly the exit price for a one-year holding period. The price of the shares can fall, even as we are at historically deep discounts to NAV if we look at the past 30y for Swiss real estate. But NAVs haven’t yet been adjusted downwards in Switzerland, and this valuation risk is clearly also given in Switzerland. So generally, we expect NAV per share to decline over the next years for most Swiss real estate funds, which could create a risk. Still, real estate asset valuation volatility in Switzerland is one of the lowest globally

Macro Real Estate didn’t want to give any investment recommendations. What we wanted was to raise the curiosity of readers. We also wanted to draw the attention of international real estate investors to CHF real estate, as in combination with the current shifts of interest rate differentials it could be interesting to think about it even as a foreign investor. Certainly, for clients, we can provide in-depth slide-packs with baskets and trades on implementing such strategies.

Some foreign currency investors prefer not to hedge and explicitly consider CHF due to its stability and longer-term appreciation trend. That is also a strategy that worked well in the past.

We neither imply that due to the currently challenging hedging costs Swiss investors should stick in Switzerland. Markets like London which are on the brink of correcting by 30%-40% could offer better value opportunities for 2023 than Swiss core real estate. It depends on what the investors are looking for. We believe there will be great opportunities especially with value added strategies in 2023 and 2024 internationally.

The focus here was on distributions, and from that perspective, the Swiss real estate market is currently very competitive from a foreign currency perspective.

Ultimately, institutional RE investors should monitor FX risks and account for hedging returns. Macro Real Estate has a strong track record assisting clients in navigating the currently quickly changing macro dynamics. We believe we can provide value, as we stand at the intersection of central banking, financing, real estate rental, and capital markets.

Leave A Comment