I had the opportunity to spend a week in Singapore for meetings and the ANREV conference for the first time since the Corona crisis and I have some key takeaways:

- I see the most significant potential for real estate investments in the Asia Pacific compared to the other world regions in a five- and ten-year view. Most investors and multi-manager products are still heavily under-allocated to this region. There is a need for action in asset allocations. However, investments in Emerging Asia would also have to be developed more strongly for institutional investors in the coming years. Such investments were still given too little attention both at the ANREV conference and in most investors’ portfolios.

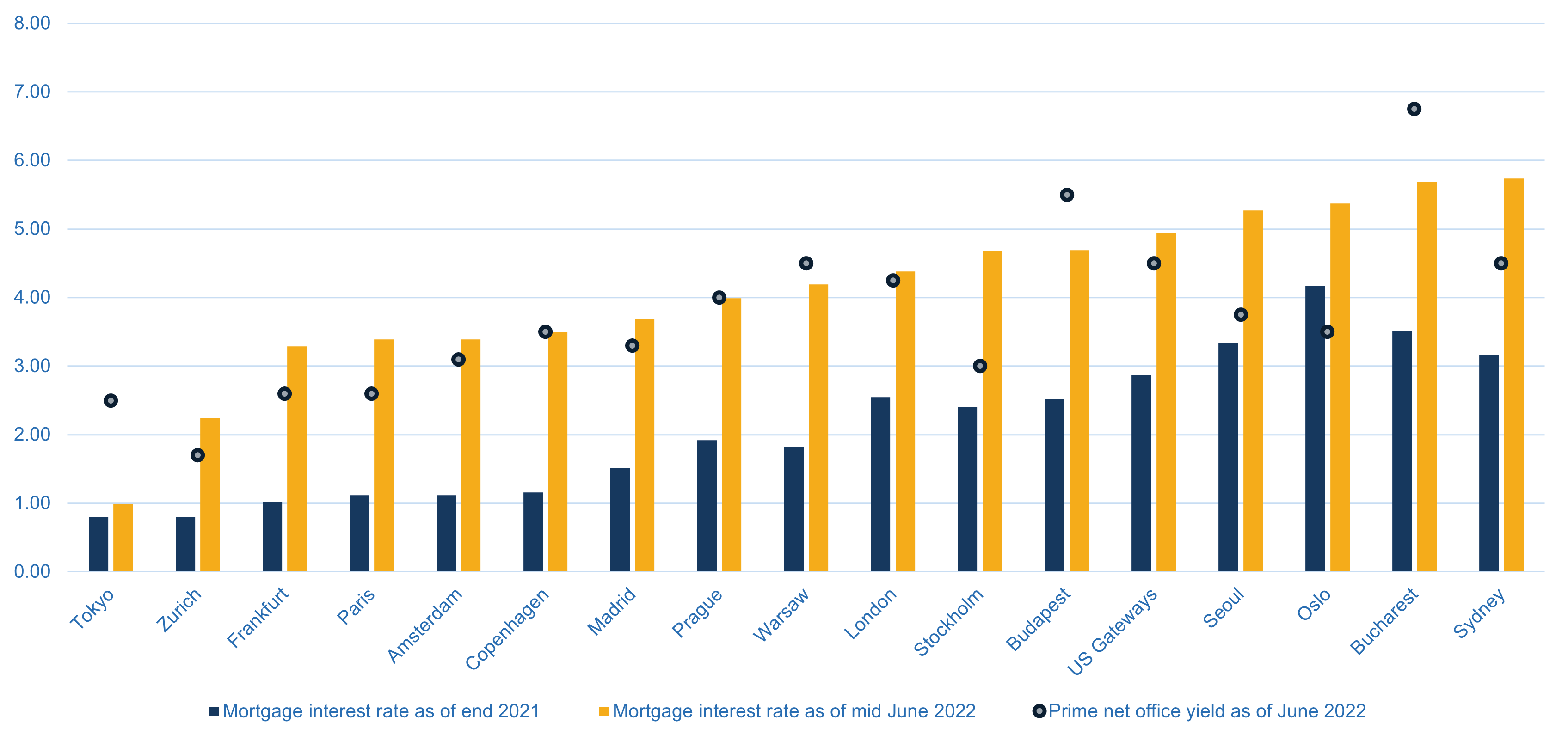

- The atmosphere at my numerous meetings in Singapore and the conference was better than it is currently in Europe or the USA. Nevertheless, various challenges exist here as well. In the short term, we expect global real estate market weakness and upward pressure on capitalization rates, from residential real estate in Switzerland to logistics real estate in the US. Figure 1 illustrates current financing costs versus net yields for prime office properties.

- The Australian markets are characterized by similar challenges on the interest rate side as the U.S. and Europe. Long-term interest rates in Australia are about 50 bps higher than in the US. Several recent deals have been “retraded” here, as in the U.S. and Europe. Logistics portfolios with about 25 bps+ increase in capitalization rates in recent weeks. More to come.

- Office rents in Australia have corrected recently, and vacancies have increased significantly. Net yields, however, were somewhat competitive and close to all-time lows. With a rise in net yields, which I expect over the next few quarters, an attractive entry window for offices in Australia could open up.

- I expect structural potential, especially for rental housing (developments) or student housing in Australia. A weaker capital market situation should be seen as an opportunity to enter. These two sectors are also among my sectors in Australia in the medium term, where I still see dormant potential.

- Japan is still “last man standing” in the old low-interest world. Spreads in favor of real estate are currently the highest in Japan. That is why various investors are presently continuing to focus on Japan. Residential has come more into investors’ focus as yields are higher relative to offices. This is unique when I compare this with other countries.

- By contrast, the office rental market had seen relatively weaker development, particularly in Tokyo. Logistics properties, which have tended to be characterized by an oversupply situation in recent years, are likely to see more robust rental growth again. My macroeconomic concerns that the BoJ’s MMT experiment could end in ruins and they cannot maintain their low-interest-rate policy is considered a risk by few market participants.

- In principle, however, you can do Japan apart from these tail risks. In Tokyo, properties with value-added potential can be found. Hotels could also benefit from the weaker JPY if the BoJ can pull this off…

- Singapore: The office rental and private residential markets are showing very bullish development: Supply can hardly keep up with demand. Most researchers expect office rents to increase by 20%-30% in the coming year. Despite the economic risks, I share this assessment. Singapore is always very cyclical, which you have to play actively. Cap rates have fallen below 3% for prime offices and are thus historically relatively low. The question in Singapore is how to get the exciting objects and the correct ticket sizes. If the global real estate capital market weakens, cap rates should also rise somewhat in Singapore. But in the medium term, Singapore should continue to benefit from Hong Kong’s weakness as an international office location. Therefore, Singapore is a market where you would rather buy.

- South Korea: The office rental and logistics markets continue to boom. We have seen solid rent growth in recent quarters. However, net returns have declined significantly in recent years. Interest rate spreads are no longer supportive. Instead, some caution is called for in the short term.

- China: The geopolitical upheavals do not stop at investors’ allocations. Some European and US investors no longer want to be invested in China. I have a slightly different view: I want to be invested in different geopolitical centers of power as an investor. China still has great potential and is likely to gain significant dominance in Asia and globally. I see the current economic weakness more as an opportunity to gain a stronger foothold here as an investor. But in the short term, some will probably still avoid China as a location, which could weigh on valuations, even if international investors are less influential in China than in other locations. However, I remain fundamentally bullish on the potential of China. The question is, when should you get in?

- India is the story of decades of untapped potential even though various real estate investors have already achieved good returns here. However, the mood at the conference was currently more positive toward India than it had been in the past. I would keep India in a pan-Asian investment portfolio but limit the exposure.

- Hospitality: Many now see the time has come for this sector, which has suffered badly in recent years. I also count myself among these investors.

As always, these comments are not investment recommendations, just my unbiased thoughts on the markets. For Macro Real Estate clients, we provide detailed analyses of the potential and risks of individual markets and assets, as well as in a portfolio context.

Figure 1: Net yields and financing costs (5-year financing in local currencies, CEE in EUR)

Source: Bloomberg, various brokers, Macro Real Estate

Leave A Comment