We deliberately have taken our time to write a new comment, as the Russian invasion in the Ukraine has also shocked us . But especially in such difficult times, it is Macro Real Estate’s task to analyze the effects of macroeconomic changes on the international real estate markets and to identify opportunities and risks. It is precisely in such uncertain times that investors are becoming more aware that they are not only operating in the real estate microcosm, but that macroeconomic effects are of fundamental importance for investment success.

First and foremost, we would like to shed more light on inflation and interest rate movements, before we then discuss the implications for the real estate markets in our next article.

Persistent high inflationary pressures in the US and Europe

As our readers, and especially our clients, know, we have not only been expecting higher inflation over the short term but also have been seeing higher structural inflation over the next decade.

Larger surges in inflation usually come in waves. The first global wave of inflation, which gained momentum in Q2 2021, was on the one hand the result of the excessive fiscal packages, especially in the US during the Corona period, which drove up the consumption of goods. On the other hand, it was also the result of interruptions in the globalized value chains, which meant that producers were unable to react immediately to higher consumption.

However, we expected inflation to start decelerating in Q2 2022 due to the US fiscal cliff and the expected global economic slowdown. With the expected adjustment to the supply of goods in 2023, we assumed that inflation would continue to fall. We had reckoned with the second wave of inflation in 2024 at the earliest. This now seems to be manifesting itself in 2022 as the effects of the Ukraine war, before the first wave has really subsided. So we have to swim against two superimposed waves.

But the inflationary pressure is not only rooted in the war. Even before the Russian invasion of Ukraine, inflationary pressure were more persistent than expected. The war in Ukraine has increased the risk that the upward pressure on consumer prices will not abate as expected. This is due to the strong role of Russia and Ukraine in the production of various raw materials (oil, natural gas) or food (Ukraine is considered the breadbasket of Europe).

Figure 1 shows the development of oil and food prices, both of which are rapidly increasing. Such increases in food prices have always been accompanied by political unrest in the past and are also likely to entail some unforeseen risks for the coming months.

Figure 1: Food and oil prices

Source: Bloomberg, Macro Real Estate

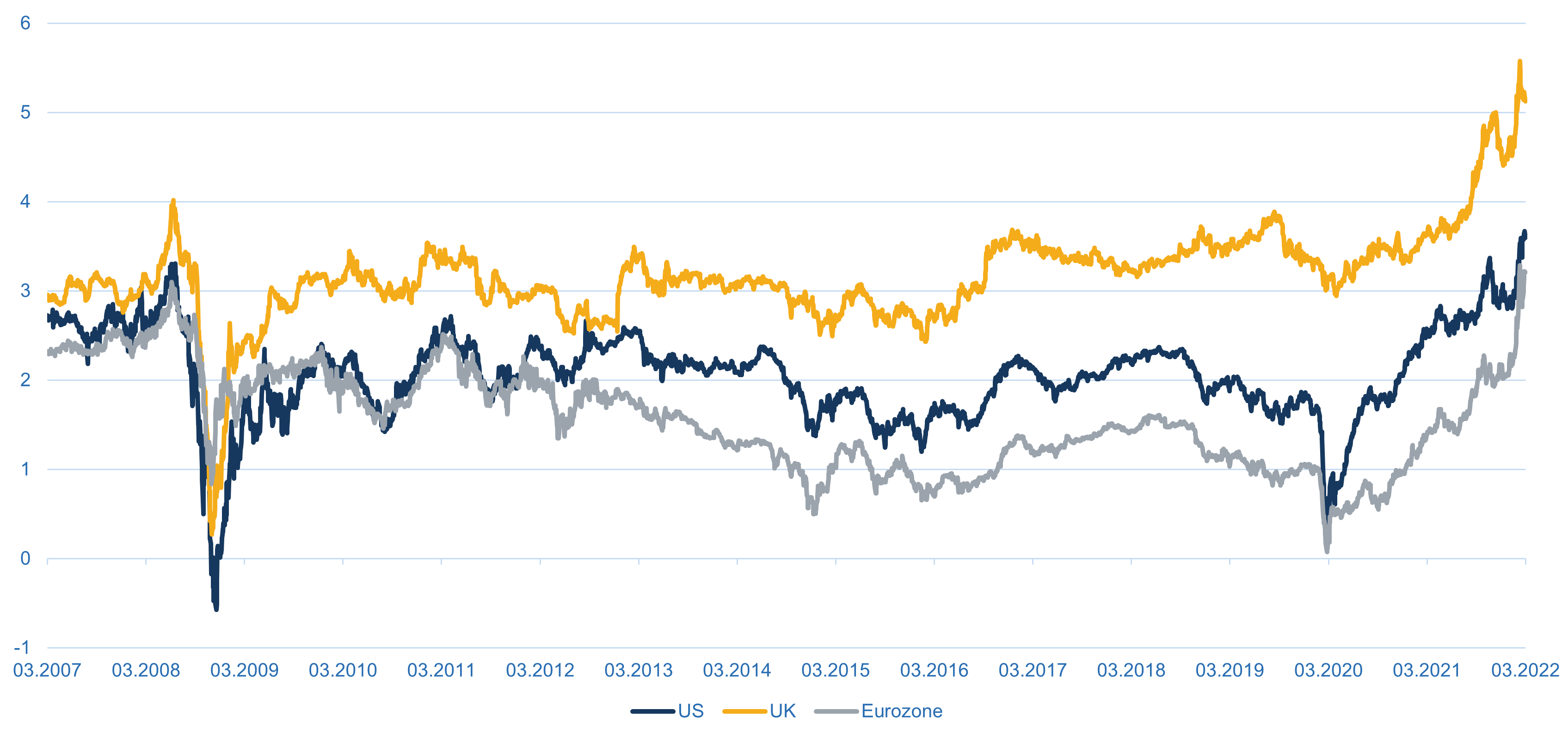

Financial markets expect inflation above 3% pa for 5 years

The financial markets are now also pricing in higher inflation in the medium term. Figure 2 illustrates 5-year inflation expectations based on zero coupon inflation swaps. We look back on a very strong increase in the last few months. In particular, it is also noticeable that in the euro area, where inflation expectations have been significantly lower than in the USA since the euro crisis, a similarly high level of inflation as in the USA is now being priced in. The massively higher expected inflation in the UK is only partially due to higher inflation expectations compared to the continent. It is also a consequence of the fact that the contracts here are linked to the retail price index and not the consumer price index, and this has greater swings due to the different components.

Figure 2: Inflation expectations from financial contracts (5-year horizon) in %

Source: Bloomberg, Macro Real Estate

The inflation surprises have almost triggered a panicky reaction from the US Fed, at least as far as communications are concerned. Since the beginning of the year, they have started to signal substantial interest rate hikes, and they have not ruled out a series of interest rate hikes of 50 basis points per meeting after substantially underestimating the risk of inflation last year.

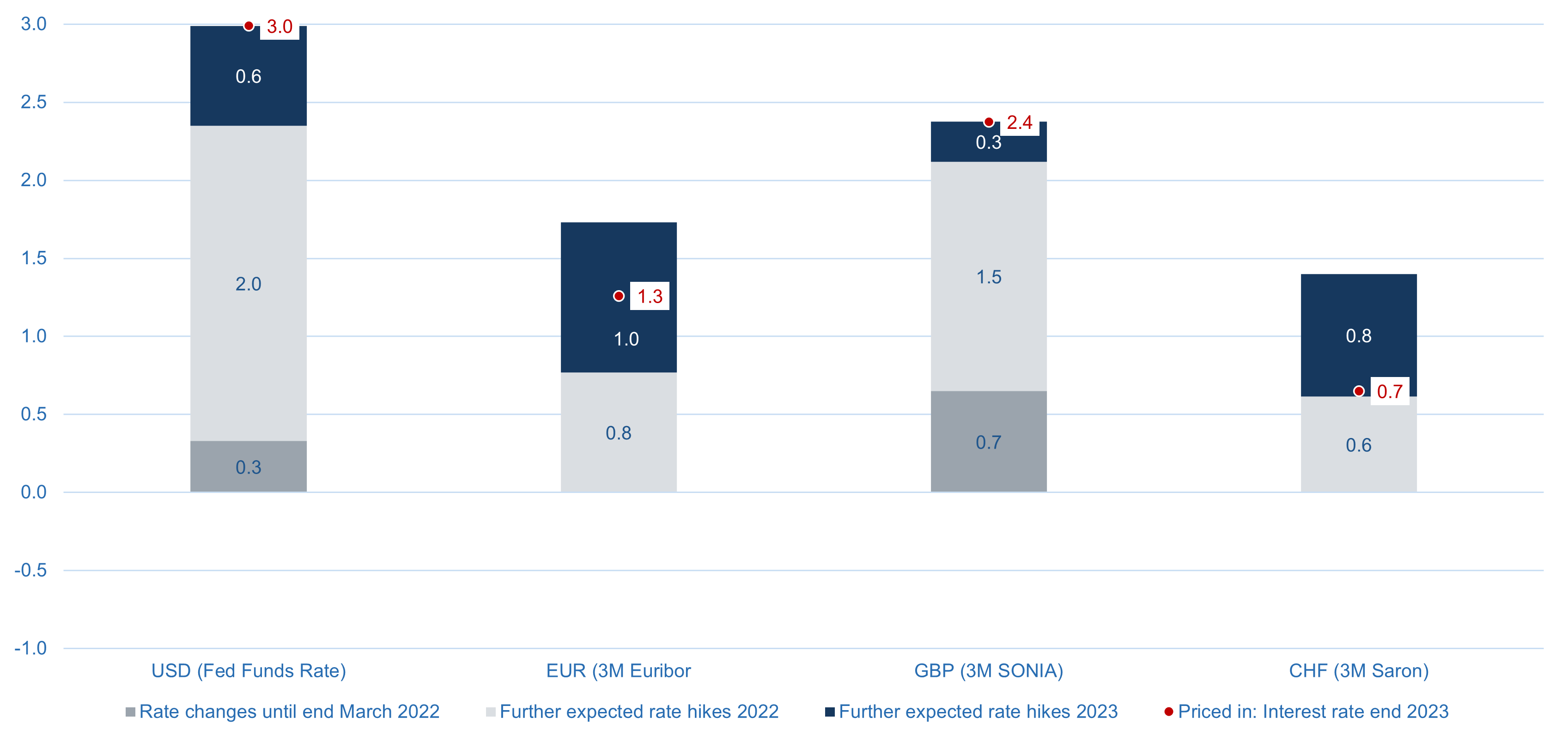

The European Central Bank has communicated more steady, but also the ECB has changed its stance. This has resulted in money market futures pricing in very significant rate hikes.

In Figure 3 we have summarized the expected rate hikes. A Fed funds rate of nearly 2.5% (ie almost 2.5% of rate hikes) is priced in by the end of 2022. Markets project another 50bps of rate hikes next year. A similar path is expected for the UK. Interestingly, three rate hikes of 25bps are already fully priced in for the Eurozone and two for the SNB this year.

However, one must note, that the futures markets can quickly price out interest rate increases again. Still, it’s remarkable what significant rate hikes are being priced in over the next 20 months.

Figure 3: Expectations for interest rate changes

Source: Bloomberg, Macro Real Estate

Higher swap rates are already having an impact on real estate financing

While not all rate hikes come, they have an immediate impact on the swap rates used for current funding. Swap rates have an impact on real estate financing because mortgage rates are calculated as a spread on swap rates. Figure 4 illustrates the already significant rise in 5-year swap rates. In the US they have already climbed over 2.5%. This puts mortgage interest rates in the range of %-5% pa depending on the spread. In the Eurozone and Switzerland, swap rates are lower from level but have risen 150 basis points since their bottom. This means that the higher interest rate expectations are already having an effect on financing contracts. If such significant interest rate increases then actually occur, this will also have an impact on the capitalization and discount rates of real estate. According to our discussions, too few market participants in the real estate sector are still expecting interest rate increases in EUR and CHF at all. As described at the beginning of the year, this is likely to catch some investors and developers off guard.

The uncertainties remain extremely high. The big question is whether the market is exaggerating at the moment or whether such rate hikes will actually happen. It can already be summarized that historic extreme movements have taken place in interest rate and inflation expectations. In view of the high level of debt in many national economies and other unintended economic side effects, such movements also harbor the risk of distortions on the financial markets and for economic development. In the next article we will describe our thoughts on the implications for the real estate markets.

Figure 4: 5-year swap rates in % for different currencies

Source: Bloomberg, Macro Real Estate

Good article! Best, Daniel