During my recent two-week business trip to the U.S., I had the opportunity to meet with more than 25 real estate investment managers in four major cities along the Pacific and Atlantic coasts. I came back with the following takeaways in my backpack:

US housing market: 2023 is not 2008

The current situation in the U.S. housing market (home ownership) differs in several respects from the period between 2007 and 2009. At the time, many households were short-term financed, mainly through subprime and Alt-A mortgages. Mass defaults occurred due to substantial “mortgage resets.” At the same time, homebuilders had too many projects underway during the boom years that were not completed until the recession. The result was a massive oversupply of non-sold homes, which burdened the market for years.

Figure 1 shows that despite the interest rate shock, the number of homes for sale remains very low. In recent months, even the number of new homes built and for sale has declined. This is because most households have taken advantage of low mortgage rates over the past decade to refinance at low rates over the long term. Many are unaffected by the rate hikes and continue to benefit from historically low mortgage interest costs. Since in the U.S. the mortgage is not transferred with the sale of a home, very few transactions are currently taking place.

The homebuilders of single-family houses have indeed realized many projects in recent years. Despite the challenging financing environment, they have slightly reduced the existing inventory in the past few months due to the shortage of available homes in the market. As a result, we have a significantly more stable environment with less downward pressure on prices than would be expected under these circumstances. In fact, the housing price indices have even shown a slight upward trend in recent months.

Nevertheless, prices are still about 10-15% above the fundamental level. New buyers cannot afford homes as long as interest rates and home prices remain at current levels. Prices need to fall. Currently, this is not happening strongly enough, as the supply on the market is limited. The real risk in this situation is a cooling of the labor market, which could significantly increase unemployment. This could result in unemployed homeowners having to sell their properties reluctantly.

Figure 1: Homes available for sale

Quelle: Bloomberg, Macro Real Estate

CRE Pricing: Core valuations still inflated

Valuations of nonlisted US core real estate funds continue to be inflated, according to our assessment. We expect institutional open-end core funds to experience further significant depreciation in the coming quarters. The weighted average capitalization rate of the core funds (based on valuations) was 4.25% at the end of Q1 2023. This means a 75 basis point lower yield compared to the interest rate an investor receives for risk-free money market investments. Queues for redemptions of shares in institutional core funds continued to increase in Q1 2023. This problem has been addressed only half-heartedly by investment managers. Many are hoping investors will withdraw their redemption requests. However, as long as portfolios are not devalued more, we see no reason why investors should do so.

Transaction volumes remain very low across all sectors. In recent months, however, there has been some movement . Industrial investment managers in particular indicated that they have more deals on the table. This indicates an improvement in transaction volumes for the coming months, so that price discovery can also progress.

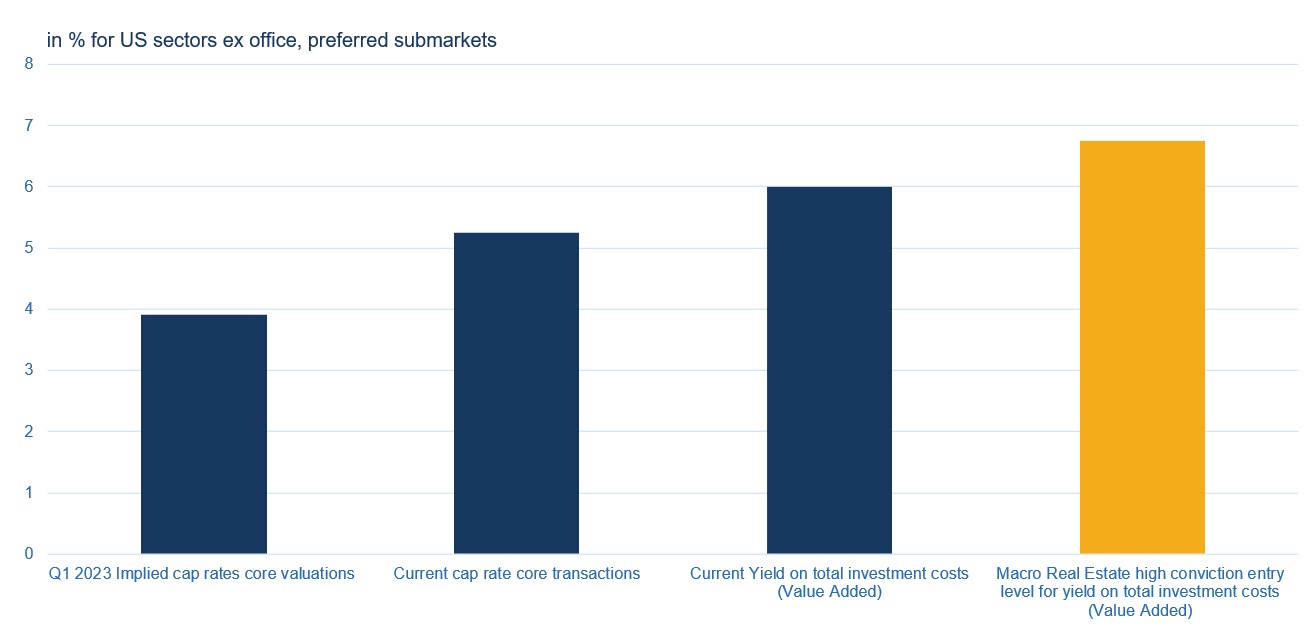

Figure 2 shows in a very simplified view how we currently perceive the valuation levels in the US commercial real estate investment market. This consideration is for our preferred real estate sectors in good locations. This includes logistics, residential, and alternative sectors such as life science, student, and senior housing (i.e., excluding the historically significant office and retail sectors).

We currently see the net yields for core transactions slightly above 5.25%. In contrast, the implied capitalization rates for core valuations were below 4% as end of Q1 2023. This means that a further repricing of the core valuations of at least 20% is necessary to bring them to the current market level. In contrast, we see the yield on investment costs on selected value added deals at around 6.0%. Admittedly, the latter can only be achieved if the business plans are executed correctly. Nevertheless, we prefer such strategies due to their attractive risk-return profile. For us to be even more optimistic, there would need to be further revaluations for such deals as well, so that we average a return of over 6.75% across all sectors. Given our expectation of further weakening in core markets and an increase in distressed opportunities, we believe we will achieve this over the next six months.

Fig. 2: Comparison of net yields

Source: Estimates Macro Real Estate

Sector views: Industrial the favorite

Office:

Sentiment towards office real estate is currently as bad as we have ever seen it. None of the 25 investment managers I met suggests currently investing new capital in the area. On the credit side, a tsunami of defaults on maturing office loans is expected, which is also likely to wash away a great many smaller banks, according to our assessment. Many larger, older buildings in both the suburbs and gateway cities are having tremendous problems finding new tenants. Conversion to residential is not profitable in some cases due to floorplates. Even though pricing levels are tempting and we have a flair for “contrarian” investments, we would wait further here.

Multi-Family and Single Family:

This residential sector has had a tremendous good time, and has been a beneficiary of structural changes regarding home offices. The situation develops differently depending on the city. However, we are generally observing a strong slowdown in rental price momentum. This is the result of a typical “hog cycle”. In the Sunbelt markets in particular, a very large number of projects were started that will not be completed until the next few quarters, also due to the construction delays caused by Corona. This is likely to result in more difficult rental market conditions for the next two years, leading to declining rents in some regions. With a lot of new supply coming in the “Class A” space, we would avoid managers/projects that typically have the large projects in their portfolios with several hundred million USD in ticket size. We tend to prefer managers who focus on smaller projects in more defensive markets, such as D.C., where supply is less likely to increase and demand remains robust due to the government sector workforce.

Demand for single-family homes for rent remains very high. In this area, expanding supply is less of an issue. Nevertheless, we believe that valuations in this area are still not attractive enough due to the inflated prices of individual houses. However, more attractive valuations can be tapped through secondaries transactions in this area.

In principle, both US multi-family and single-family remain indispensable portfolio components that strategically belong in global real estate portfolios. We would currently wait a little longer for price discovery in this area, before making new invetsments. Since few new projects are currently being started, too little supply is likely to prevail again in the medium term (i.e. in 3y). This means that if there is a weak phase in the following quarters, this can be used for a favorable entry.

Logistics Real Estate:

This sector has had a fantastic run over the last five years. For us, it is currently the preferred sector to deploy new money. Yields on investment costs for value added projects have already corrected significantly, so that a positive contribution can be generated through the use of leverage. Supply has not yet increased as much in the sector as it has for multi-family. Again, the rental market is cooling but most managers gave us guidance of 4%-6% rental growth p.a. for the next few years (some even 10%+ NOI growth for the next 3 years). Although this is probably on the more optimistic side, we think the combination of higher yields and positive rental growth will lead to further outperformance of this sector.

Other sectors:

- Life Science: The situation is no longer as optimistic as it has been in recent years. Rental growth is slowing significantly and net yields for core assets remain arguably too low. I’ve had a few conversations with Boston area managers who see an oversupply of space. In contrast, other markets, e.g. San Diego seem to continue to perform well. Opportunistic managers also continue to look at this sector for opportunities. In general, I continue to see the sector as structurally positive; however, the next few years are unlikely to bring the very strong returns of previous years, as the market is in a consolidation phase.

- Retail: Despite outperformance over the past few quarters, most managers remain cautious. Given the rise in consumer price levels, discretionary spending remains under pressure. We remain cautious but are watching how the pricing develops in the coming quarters.

- Hospitality: Opinions differ on this and it also depends on the type of assets. Some markets, particularly San Francisco, are struggling with defaults. Other markets that depend on tourism are on the rise. Hospitality was an important investment theme for us during the lockdowns. Currently, however, the issue has subsided somewhat, as performance is already very positive.

Conclusion: Patience still required

Overall, I had the impression that the current economic situation is somewhat better than the general economic statistics suggest. We are closely monitoring the economic developments in the coming quarters, as these will also be critical quarters for real estate pricing.

The development in the labor market is likely to remain the most important influencing factor for various commercial real estate sectors as well as for the housing market. Due to continued high interest rates and banks’ limited appetite for risk, defaults in the commercial real estate sector are likely to increase sharply in the coming quarters.

Valuations of core real estate assets are still likely to fall substantially in such an environment. We expect that even more interesting entry points for value added projects will materialize in terms of pricing towards the end of this year/beginning of next year. We already see interesting repriced opportunities for logistics properties though. Secondaries also promise opportunities in such an environment.

Leave A Comment