By Dr. Carri Duncan and Zoltan Szelyes

Carri is Managing Partner at Karaktero, an advisory and capital services consultancy catering to Healthcare and Technology industries. Contact info: carri[dot]duncan[ät]karaktero[dot]net

Zoltan is CEO and owner of Macro Real Estate, a research based international macro and real estate advisory firm. He is also heading the international real estate investment arm of Dicoval, a Swiss single-family office. Contact info: zoltan[dot]szelyes[ät]macrorealestate[dot]com

The world is currently living in a series of black swan events: war, inflation, de-globalization, a 3rd year pandemic, and now the end of a decade long bull market with recession risk.

In this macro environment, we expect a handful of industries to not only sustain themselves but emerge and thrive. However, investors should not forget Seth Klarmans advice market outperformance “Worry macro, invest micro”. Our present capital market environment can provide very attractive circumstances for 2022 and 2023 vintage investments. Investors deploying cash should not look at the current market, but rather anticipate where the economy and societies will be in 5 to 10 years. We believe innovations, technological change and structural trends continue to provide ample opportunities in the technology-enabled health care arena.

2022: Selloff in both stocks and bonds

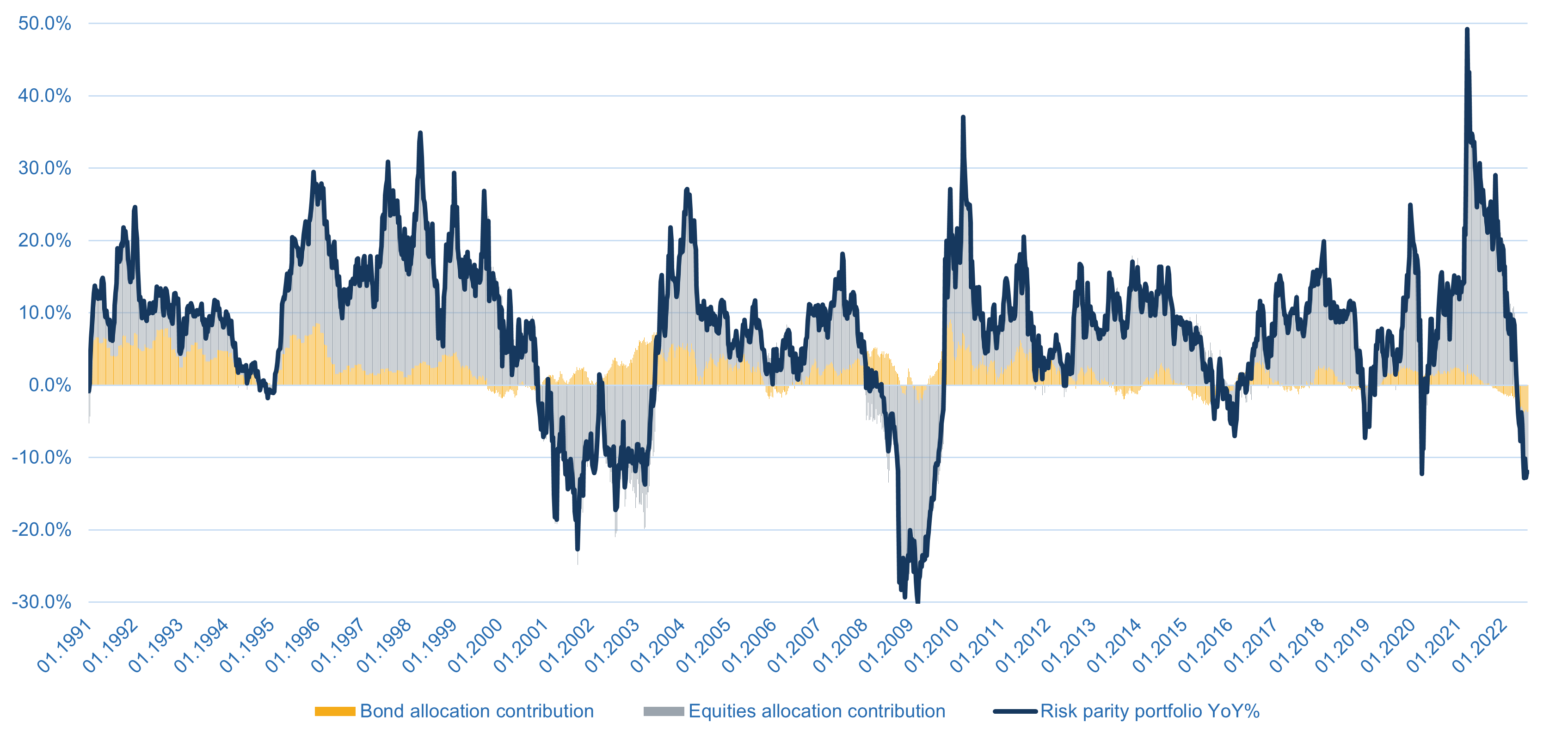

This year, we’ve witness no lack of challenges on the investors’ table. The risk parity asset allocation strategy that has been popular with investors, mainly those only operating in the public markets, foresees an allocation of 60% into equities and 40% into bonds. As shown in figure 1, that strategy has suffered a major blow. The YoY performance of this strategy is similar to major “risk-off” years. The decline of the stock markets proxied by the S&P500 is not as deep as in other market selloffs yet. The real issue is that bonds, which would need to provide a counterweight in times of equity market turmoil, have seemed to record an even broader meltdown compared to their historical volatility. For some bond indices, 2022 YTD has been the weakest year on the record. In YoY terms, the risk parity portfolio is down by 12%, with a negative contribution of bonds of 3.7% and stocks 8.3%.

Figure 1: Risk parity portfolio returns YoY

Source: Bloomberg, Macro Real Estate AG

Structural shifts and accelerators in the inflationary landscape

Inflation is at the forefront of the current market adjustments. We believe there has been a shift in the inflationary drivers in recent years that has been accelerated by two key events: Covid-19 and the war in Ukraine.

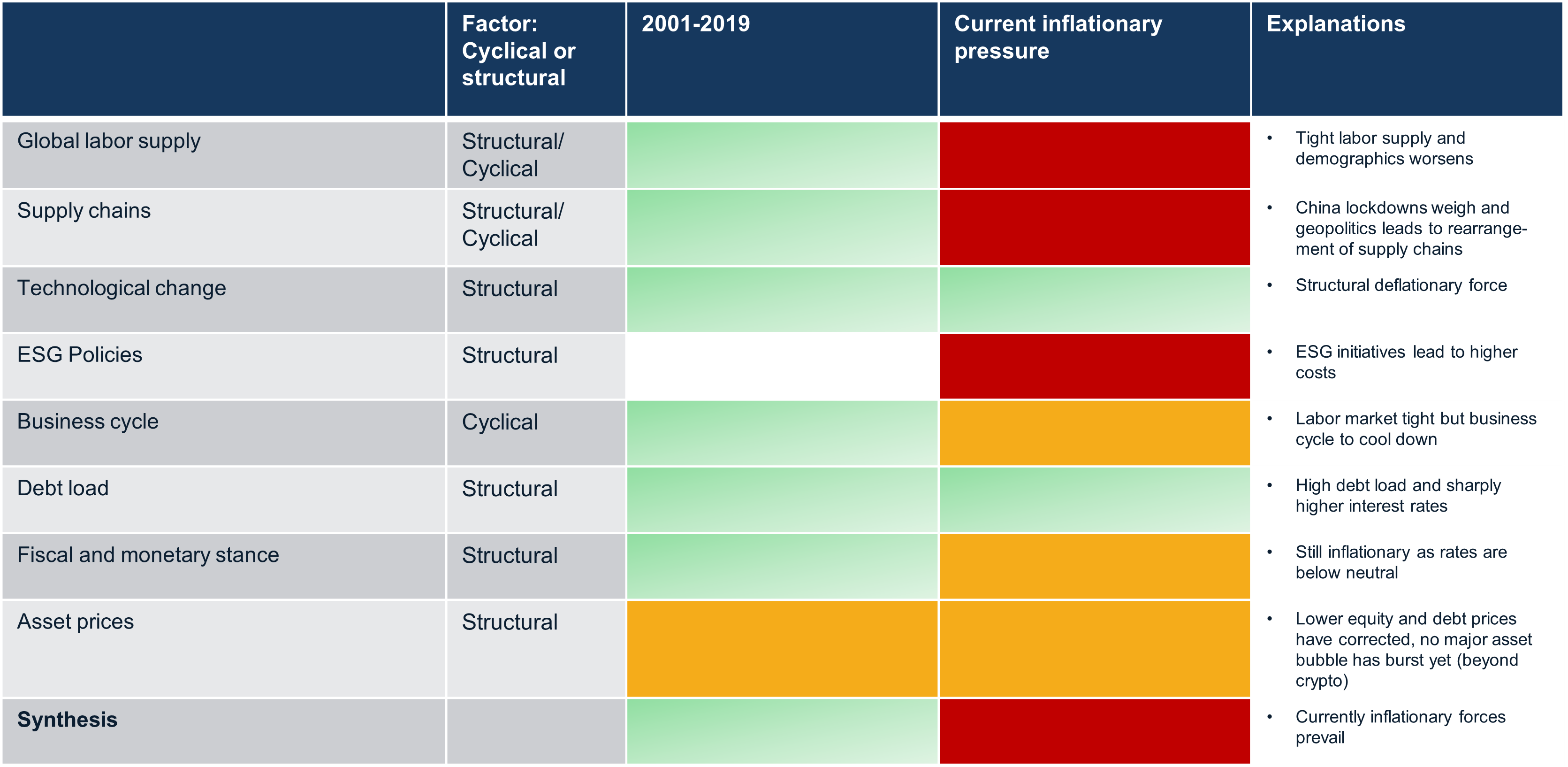

Figure 2 summarizes the inflationary drivers. For the past two decades, a myriad of factors have created a low inflationary and low-interest rate environment. The entry of China into the WTO in 2001, combined with a globalization trend, had the benefit that companies could tap an almost endless pool of cheap labor. With technological progress, supply chains were set up globally, bringing little inflationary pressure. Additionally, the GFC, the Euro crisis, and the subsequent fiscal austerity policies have unleashed further deflationary forces that brought about a negative interest rate environment in Europe.

However, some of the underlying forces have already started to turn some years ago. We see changing demographics and rising geopolitics as the two main structural drivers that have shifted from being disinflationary to inflationary factors.

Figure 2: Cyclical and structural drivers of inflation

Source: Macro Real Estate AG

As globalization also created some losers and the rapid rise of China was increasingly seen as a threat in the Western world, a populist backlash emerged. Globalization turned to what The Economist newspaper described as “slobalisation”. Tariffs on international trade during the Trump period were one of the first signs of a shift in the cards. Moreover, demographics are slowly evolving moving from deflationary to an inflationary driver. As the baby boomers also began to retire in the West, the growth of the Chinese labor supply slowed. In the two years since Covid-19 erupted, the global economy has faced several disruptions in the supply chain and dislocations of labor markets. The most inflationary single factor was perhaps US fiscal policy. The US countered Covid-19 with an enormous fiscal impulse of 13% of GDP coupled with careful monetary easing policy. Europe also followed the path of expansionary fiscal and monetary policies on the back of more than a decade of very easy monetary policy.

Hence, the global economy was already on a path of structurally higher inflation when the Russian invasion of Ukraine brought even more disruption to the supply chain, particularly for food and energy.

Interest rate shocks and stagflation angst

Most central banks in industrial countries initially identified the inflation pressure as transitory and continued their expansionary monetary policies throughout 2021. In late 2021/early 2022, they realized that they were way behind the curve. Thus, they began to normalize the interest rates. Long-term swap interest rates and bond yields have also reacted violently by increasing 150-200 basis points within a short time. The FED has already tightened by 250 bps YTD, and the market expects them to continue to raise interest rates further. Central banks from APAC to Europe also are on the same path of rapid tightening.

The rapid interest rate rises acted as a shock to financial markets. In addition to the equity market and higher bond yields, credit risk premia are increasing. The steep rise in financing costs and the withdrawal of liquidity is usually harmful for economic growth. Recession probabilities have risen for the US and Europe. Some market participants even fear stagflation like in the 1970s.

Public proxies for healthcare and biotech markets

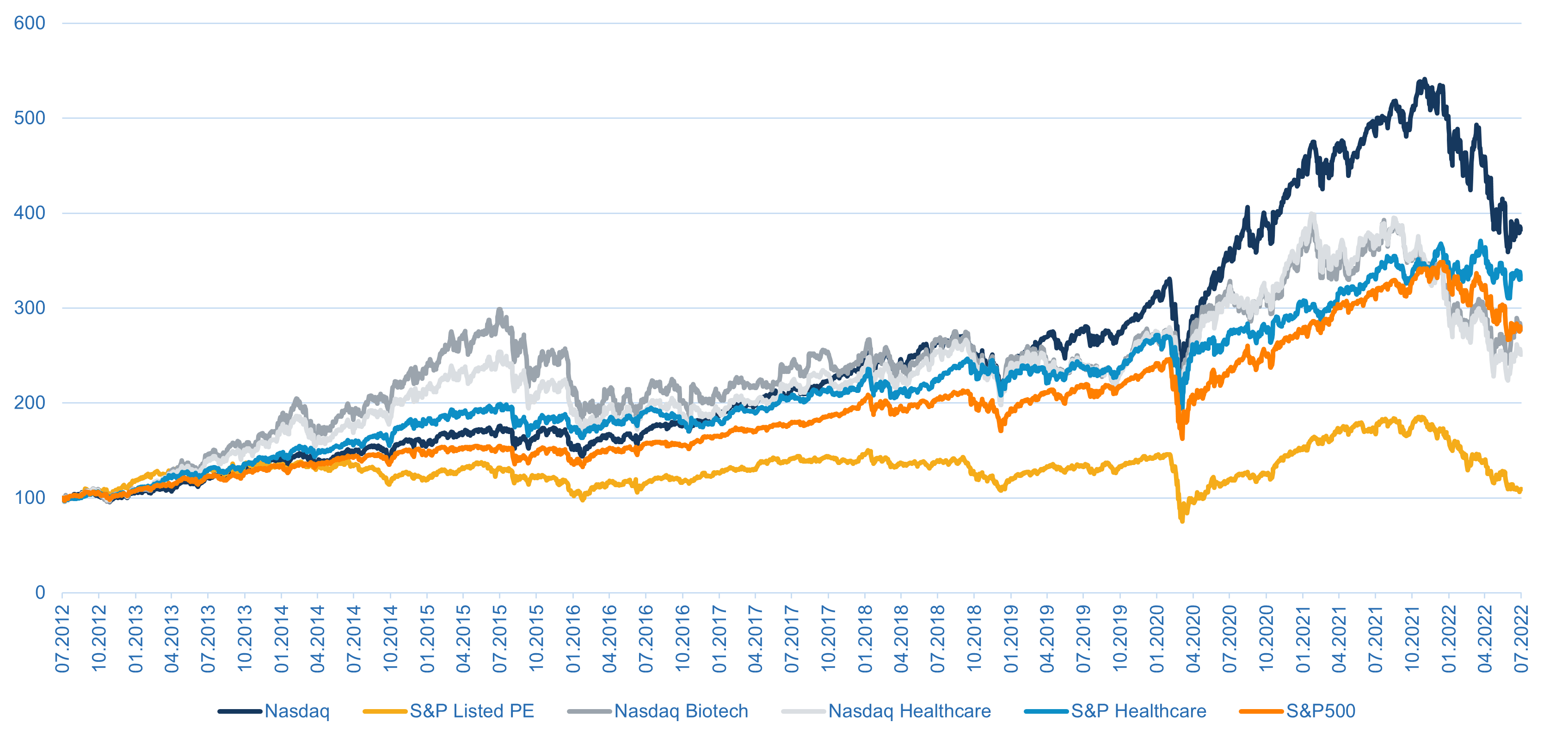

If we look closer at some public proxies for health care and biotech markets, the environment has become much more unfavorable. As figure 3 shows, especially growth-related assets such as the Nasdaq or Nasdaq Biotech have been more affected, while the S&P500 and the more defensive S&P 500 Healthcare index have been relatively outperforming. The strongest correction is shown by the listed PE index which has declined by 40% since its peak in November 2021, but the Nasdaq healthcare index is also down by 30% since then.

Figure 3: Listed equity indices

Source: Bloomberg, Macro Real Estate AG

Basically, companies that rely on financing without regular cash flows will be more challenged in this environment, as financing has become more expensive. Additionally, the more challenging economic environment weighs on the demand perspectives. Nonetheless, there are opportunities, especially for healthcare where some demand is not cyclical, but driven by structural trends such as the effect of aging on healthcare systems, consumerization of healthcare and digitalization.

Private markets: J-curves and differences between entry and exit environment

For private equity investors and investment managers involved in health care private equity markets, the question is how the altered financial environment affects the ability to achieve the desired returns. Clearly, some investors and managers who have invested over the last three years with inflated valuations priced at low-interest rates, hoping for an exit in a favorable market environment, have suffered a major blow. We think those vintages that were planning for an exit in 2022 and 2023 are now negatively affected. The weakness of the public market shows, that exits are now going priced at lower multiples. Some IPOs are not taking place but the pace has strongly decelerated.

For some of the portfolio companies seeking financing to fund their business ideas, the situation has become much tougher. With the higher interest rates, financing costs for the debt have sharply increased. Also, equity is not as freely available, as some of the “tourist investors” that were looking at making quick returns in health care PE are now discouraged and has left the sector.

Private investors who are serious about funding innovation take a longer-term approach. As we know there is a J-curve between the investment and exit of 3 to 7 years and more protract and deep, the earlier the investment. Therefore, we believe that what is currently seen as an unfavorable environment for exits is conversely a much lower risk environment to deploy cash compared to recent years. The lower competition with other PE/VC investors means that the levers for the negation are again more skewed on the investor side. Deals can be now much better structured. History has also shown us, that investing at weaker years can generate the strongest IRRs. While we expect private market valuations will continue to see mark downs, venture capital, particularly at earlier stages, are comparatively buffered as some areas will continue to substantially grow.

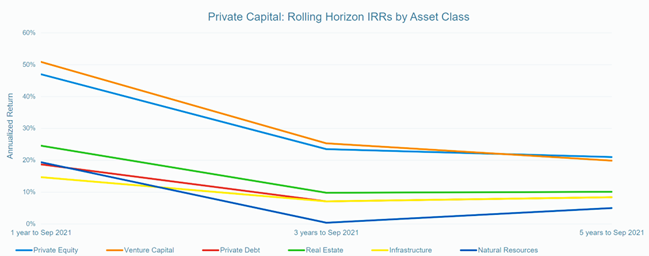

Venture Capital Leads Performance in Private Capital

Within Private capital an overarching term here describing the asset class which includes Private Equity, Venture Capital, Private Debt, Real Estate, Infrastructure and Natural Resources, the venture capital asset class currently leads performance. As sources of new capital dry up for early-stage founders seeking capital, we could see an uptick in private debt driven by venture debt’s growth as a financing option.

Figure 4: Rolling horizon IRRs by asset class

Source: Preqin Pro, Karaktero

European Venture Capital Outpacing US, Asia

According to PitchBook’s Q2 2022 Venture Report, startup deal value stood at roughly 40% and 30% of 2021 levels in the US and Asia, respectively. In contrast, capital invested in European startups has already exceeded 50% of last year’s total, forecasted to surpass the €100 billion mark for its second consecutive year.

While we have yet to experience the full impact of the changing macroeconomic environment, the first half of 2022 indicates that Venture Capital dealmaking in Europe may outperform both the US and Asia.

Investors and startups response to the downturn

Markdowns seen in the public markets have emerged in the private capital markets, and not only for late and growth stages. Although early-stage companies are likely several years away from an exit, following a delay, valuations at this stage are in part exposed to downward pressure from the market.

Pricing pressure is reflected in the evolving seed and series A financing requirements. Annual Recurring Revenue expectations for startups raising a series A have ratcheted up implying that early-stage companies will need to tighten their belts to reach their next round, forcing extension rounds in the interim.

In parallel, VC investors are now faced with valuations inconsistent with today’s market have some tough choices to make. That said, unlike the 2008-2009 downturn, we are in a more mature market that has historically high levels of cash to deploy. Many are re-evaluating their startups while simultaneously on doubling down on investment in conviction portfolio companies.

In contrast to the myriad of entrants vacationing into private markets in recent years, Europe’s growth potential and relative resilience is attracting investors with domain experience into the space. These strategic investors have the patience and experience to weather the storm, but which areas are emerging as most robust? We believe that industries well-positioned for structural shifts will attract investors with deep sector expertise and therefore poised to thrive.

Healthcare: where to play in this defensive industry? A Spotlight on Technology-enabled Healthcare

Digital Health companies create hardware and software solutions that support individuals, care givers and healthcare systems to provide insights, track and communicate healthcare topics beyond traditional analog methods. This vertical has emerged joining the ranks of traditional healthcare industries, with digitization gaining its strongest global boost via the Covid-19 pandemic. Regulators, insurers and Pharma companies who were rather cautious of such technologies just a few years ago, supported and drove its development at light-speed, notably remote patient care and monitoring across multiple therapeutic indications. Yet, there remains a huge unmet need that we believe Digital Health is uniquely positioned to substantially fill. A study published this year in the British Medical Journal noted a record level of referrals for mental health services. Indeed, previously stigmatized mental health and neurological challenges are now targeted for digital approaches. Accordingly, regulators worldwide continue to adjust their frameworks and compensation schemes to accommodate Digital Health monitoring and treatments.

The Centers for Medicare and Medicaid Services (CMS), the U.S. federal agency that works with state governments to administer Medicaid and manage Medicare and the Children’s Health Insurance program have incorporated new reimbursement codes for virtual patient monitoring into Medicare’s fee schedule including in 2022, signaling the continued expanded reach of Digital Health technologies into healthcare systems.

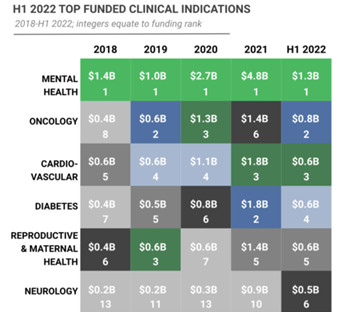

Digital Health venture financing mirrors this demand, with startups focusing on mental health indications most highly funded within this segment (see figure below). With record occupational burnout, a public mental health crisis, the consumerization of healthcare and financial pressure on public healthcare systems, we expect deals to continue in the space, albeit at a more normalized pre-2021 pace. Scalable solutions tackling unmet needs in mental health (e.g. depression and anxiety) and the nascent vertical Digital Neurology (e.g. ADHD, MS, and PTSD) solutions are particularly interesting emergent areas in Digital Health.

Figure 5: H1 2022 top funded clinical indications

Source: Rock Health, Karaktero

In response to this segment’s rapid growth non-historical investors and tech firms appeared, often encouraging a “move fast and break things” mindset to growth. Another side effect was startups entering the space who were unfamiliar with health impact, be it from the patient, caregiver or policy perspective. In our view, the specialist healthcare investors will understand the highly regulated nature of healthcare ecosystems, can assess if startups remain regulatory-compliant and understand value-add for exit strategies into this ecosystem will outperform generalists. Importantly, the ethics surrounding the use of patient data as well as data security is a critical part of this industry’s sustainable growth. Big Tech will continue to play a crucial role for the industry’s development.

Another area in healthcare that we see attractive is medical biomanufacturing. We all witnessed the vulnerability of global health exposed in part by the lack of vaccine manufacturing facilities. Europe presents attractive opportunities for consolidation and growth of this industry due to capacity limitations of larger Pharma players.

Notably, US Q2 GDP will be released on July 28th will offer more insights on growth. In any case, we’re taking a long view and expect the private capital (PE and VC) asset classes will continue to provide alpha. However, finding the more attractive routes across verticals will require fund managers with domain expertise who are able to sift break-out emerging trends within this unpredictable macro environment.

Leave A Comment