2022 and 2023 were difficult years for Swiss and international real estate investments.

In 2023, the Swiss real estate market experienced its weakest year since the major real estate crisis in the 1990s. Net yields on the transaction markets rose by around 30 – 50 basis points, which corresponded to an average fall in transaction prices of over 10%. However, valuers only reduced real estate values by 1.7% (MSCI Index) as they saw too little evidence for major adjustments.

The real estate markets abroad experienced a more negative evolution. Net yields on the transaction markets rose on average between 150 and 200 basis points. Valuations were adjusted downwards by an average of between 15%-25%. For office properties over 50% in some cases.

In contrast to the general perception in Switzerland, the international real estate markets did not present a uniform picture. The decline in property values was significantly less than during the financial crisis and varied considerably between the different sectors and regions. Significant increases in net operating income were recorded in many residential, logistics or alternative real estate sectors. Values in Asia-Pacific (ex China) clearly outperformed Europe and the USA.

Unfortunately, some Swiss investors and investment managers failed to correct the strong historical focus of their international investment portfolios on office real estate and the USA and diversify more strongly into sectors such as logistics, residential or Asia-Pacific. This led to unnecessarily very negative investment returns and a lot of frustration.

Stronger price recovery of listed real estate investments abroad

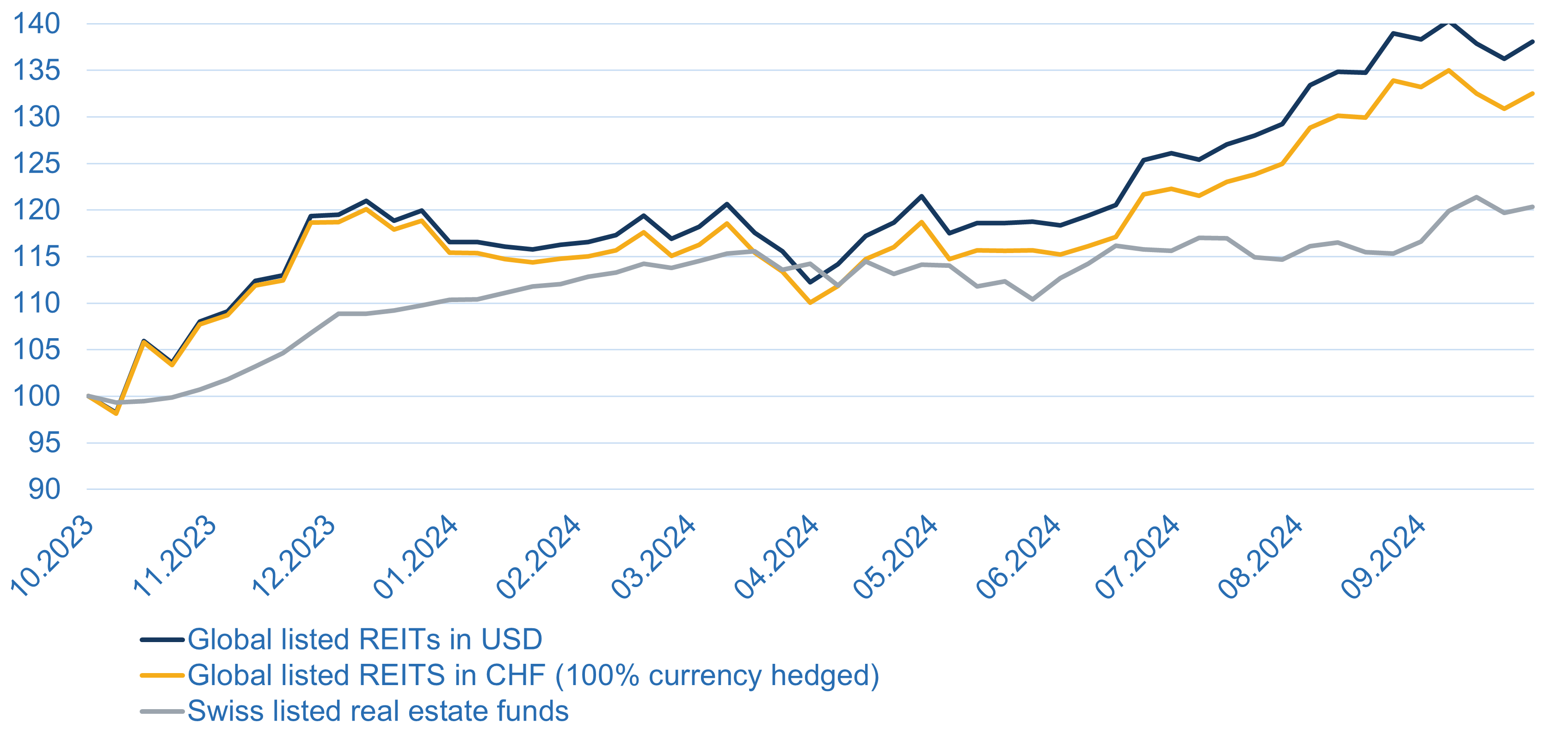

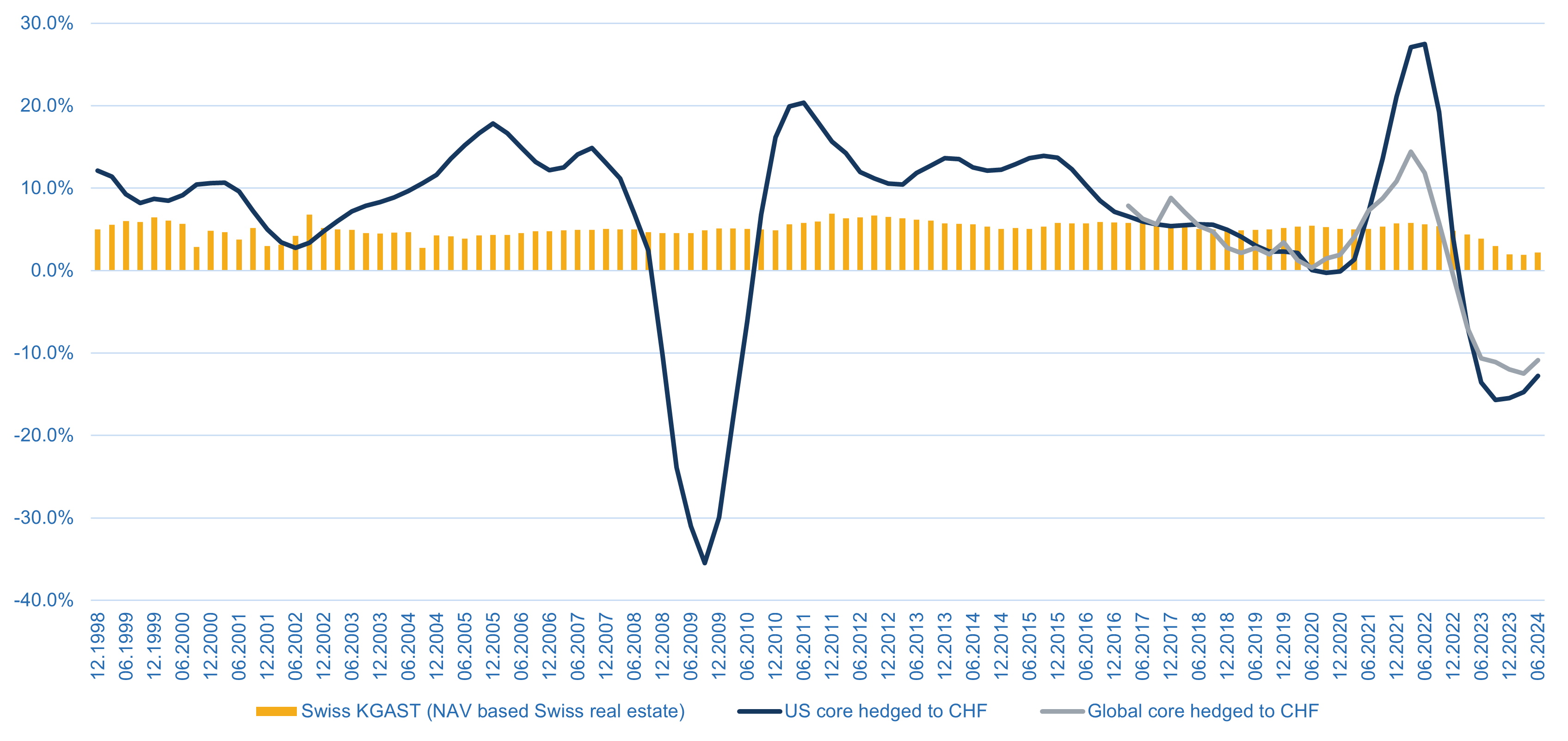

Due to their forward-looking nature, financial markets react more quickly to changes than the direct real estate markets. However, they are also significantly more volatile and overreact to both sides. This also applies to listed real estate products. As at 18.10. 2024, global REITs in CHF achieved a total return of 32% compared to the previous year (after hedging foreign currency risks). The total return on Swiss real estate funds was 20%.

With such fantastically high figures, it should be clear to the reader that this was not driven by distributions but largely by price performance. Of course, it must be borne in mind that October 2023 was the low point of the current cycle and that there was an equally negative performance before that. Nevertheless, this “rebound” can be seen.

Figure 1: Performance of Global REITs in CHF and Swiss real estate funds (total returns)

It is also interesting to compare developments between Switzerland and international. As we can see in this chart, Swiss real estate funds and global REITs were on a par in April. Since then, listed foreign real estate has performed much more strongly. One of the reasons for the lower price gains in Switzerland was the high valuations on the one hand, but also the FOMO (Fear of Missing Out) of various real estate investment managers on the other.

The Swiss market recorded an enormously high volume of capital increases. We assume that indirect real estate products in Switzerland will raise up to CHF 4 billion in new equity in 2024. On the positive side, this has been successful, particularly in the case of investment managers managed by insurance companies, which have raised large volumes. However, as they were unable to place these funds fully on the market, they subsequently acted as sellers.

However, considering the lower relative volatility of Swiss real estate funds compared to REITs, investors can be very satisfied with the performance over the last twelve months.

Significant global decline in inflation in 2024

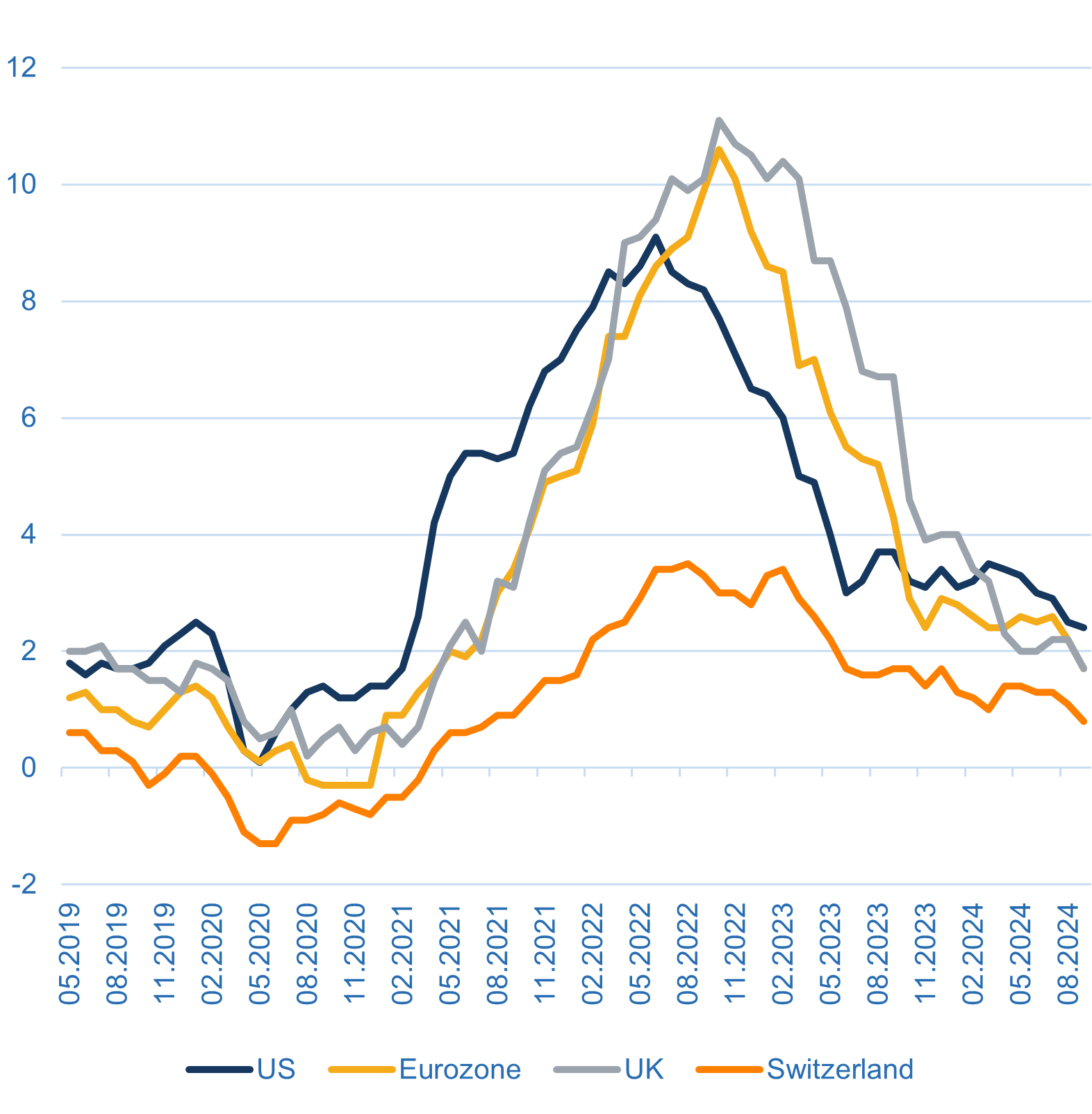

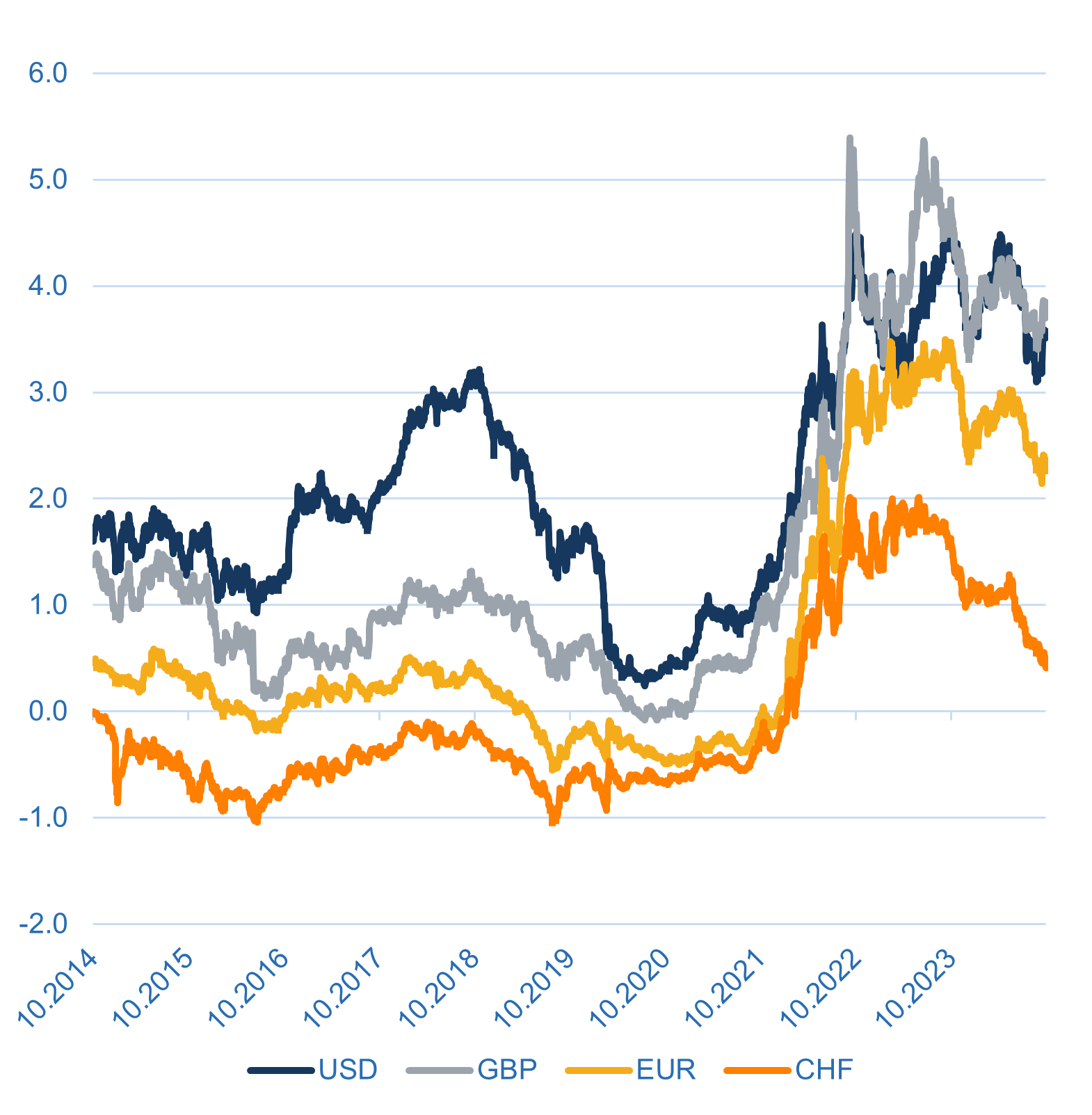

A significant fall in global inflation made such a strong development possible. In Switzerland, inflation is already at 0.8%. As Figure 2 shows, inflation has now also fallen below 2% in the eurozone and the UK. This has led to a significant recovery in financing costs. In Switzerland, the 5y swap rate was only 0.38% in October. In the eurozone it was 2.23%, while in the USA it was 3.56% and in the UK 3.91%.

Despite the different levels, these levels represent an enormous easing of financing costs for all these real estate markets. Interestingly, despite the interest rate cuts, there is still uncertainty around yield levels. In response to the 50 basis point jumbo interest rate cut by the Fed, a further fall in 10-year yields on government bonds would have been expected. However, these have surprisingly risen by 50 basis points since then.

Figure 2: Headline inflation compared to the previous year

Figure 3: 5y swap interest rates in %

Structural inflation: Are we wrong?

(If you are not interested in the structural inflation discussion, please scroll directly to the Real Estate Outlook 2025)

We continue to believe that inflation will be structurally higher on average over the next few years than in the 2010s. However, the current inflation forecasts of central banks and consensus economists show no sign of this. Financial markets are also very relaxed about inflation risks. The Swiss National Bank (SNB) expects average inflation of around 0.7 % for 2025 and 2026 and, according to its own statements, even believes a return to negative interest rates is possible. Other central banks are also largely of the opinion that inflation has been beaten, otherwise they would not have cut interest rates so rapidly in such a short space of time.

We are right to ask ourselves whether we have made a mistake and are still wrong in our assessment of inflation risks.

A distinction must be made between structural and cyclical effects on inflation. In every phase of structural inflation there are phases of disinflation. This is unavoidable for mathematical reasons and is the result of cyclical factors.

For the first half of 2024, we expected a sharp decline in inflation in Western countries. This forecast was based on the assumption that the supply-side effects that had triggered the wave of inflation would subside and that the interest rate hikes would have a delayed effect on consumption. This assumption proved to be largely correct. From July 2024, however, we expected a slight rise in inflation in Europe again, based on the following reasons:

- Stronger growth in Western Europe from H2 2024

- Rebound of the Chinese economy

- Geopolitical risks: Rise in oil prices after the base effects of commodity price rises fade out

These expectations of an increase in inflation for the second half of the year proved to be wrong.

We see the following reasons for this:

Weaker demand for commodities and weak impetus for the global economy from China have dampened inflation.

Europe was flooded by cheap Chinese exports: electric cars, for example. China’s economic weakness was one of the main reasons why inflation was able to fall so sharply in the first place. As China was unable to sell its products in the weak domestic market, it decided to export them. As a result, Europe in particular imported deflation from China. Switzerland to a greater extent due to the appreciation of the Swiss franc.

The uncertainty surrounding the French presidential elections under Macron also led to a reluctance to invest in Europe. Political risks therefore tended to have a disinflationary rather than an inflationary effect.

European economic growth remained weaker than expected overall, with Germany suffering from a structural weakness in demand. The expected rebound of the European economy is still a long time coming…

Although geopolitical risks have materialized, particularly as a result of tensions in Israel, Lebanon and Iran, the expected rise in commodity prices has failed to materialize.

We have adjusted our expectations for 2025 in line with these developments. We no longer anticipate a substantial rise in inflation over the next twelve months. Nevertheless, we still believe that we are in a phase of higher structural inflation and think that there is a risk of another wave of inflation in the next three to five years.

Our theses on why inflation is structural and further waves of inflation are likely are based on the following factors:

- Geopolitical conflicts continue to increase and could lead to supply shocks. As commodity production is largely not in the hands of the Western world, higher commodity prices can be used as a weapon.

- Reshoring/nearshoring as a result of geopolitical tensions: The build-up of duplication leads to an increase in input costs.

- Europe and many parts of the world are underinvested in defense. Rearmament would increase the demand for raw materials, which would have an inflationary effect.

- The AI boom is leading to higher demand for energy.

- Fiscal deficits in the West remain high and governments are likely to revert to direct cash payments to the population (in the form of checks) in times of economic weakness.

- The retirement of baby boomers and political responses to migration are limiting the supply of labor. This is already underway in Europe, and a potential Trump election victory could have similar effects in the US.

Despite these risks, cyclical factors, which have a disinflationary effect, predominate for the time being. Nevertheless, we could be wrong.

We see the greatest risk that the feared wave of inflation will not materialize in a faster than expected widespread adoption of artificial intelligence, which could lead to a deflationary trend in wages in the service sector and a reduction in energy costs through the use of green technologies. Both are expected in the medium term. However, our thesis is that the inflation-driving factors described above are likely to materialize beforehand and could bring us another wave of inflation. We therefore remain vigilant.

Don’t fight the central banks

The most important thing for real estate investors at the moment is that they have the green light in terms of inflation and interest rates over the next 12 months. Nevertheless, they should bear in mind that there is a real risk of another wave of inflation in the next three years. The mantra “Don’t fight the FED” applies on the financial markets. Real estate investors can apply this principle to all Western central banks next year: “Don’t fight the central banks”.

We assume that key interest rates in Switzerland and Europe will continue to fall until the middle of next year. In the USA, however, the outlook is somewhat more uncertain. We believe that further interest rate cuts are likely by the end of the year, but the US presidential and congressional elections could play a greater role here.

Re-introduction of “toxic” negative interest rates in Switzerland?

We fear that the SNB will cut the key interest rate to 0.25 % by the middle of next year, as it is mistakenly trying to combat the appreciation of the Swiss franc through interest rate policy.

However, the franc is appreciating due to geopolitical risk events and a more restrictive Swiss fiscal policy compared to other countries. This does not mean that Swiss fiscal policy is too restrictive in absolute terms, but rather relative to other countries. In a way, Switzerland is a victim of its own successful fiscal discipline. In an age in which fiscal deficits abroad are getting out of hand, a disciplined policy has a negative impact, even if it is the right thing to do in terms of public policy. The Swiss franc remains a “safe haven” like gold. If a weaker franc is desired, fiscal policy rather than monetary policy would have to be loosened in Switzerland. However, such plans fail due to both the political realities in Switzerland and the debt brake.

With its interest rate cuts, the SNB is fighting against the appreciation of the franc like Don Quixote against windmills or Sisyphus, who was forced to roll a heavy rock up a steep mountain, only for it to roll down again just before the summit each time.

This again carries the risk of the introduction of negative interest rates should a major economic shock occur next year. Negative interest rates are a toxic instrument and a perversion of the monetary system. By cutting interest rates prematurely this year, the SNB has unnecessarily squandered valuable ammunition that could be urgently needed later. In this sense, it is steering us back towards negative interest rates. We would like to see a central bank that does not act short-sightedly but keeps an eye on long-term developments and tries not to repeat the mistakes of the 2010s. Unfortunately, however, it is acting too academically; in our opinion, it was precisely the SNB’s policy (together with that of other Western central banks such as the Fed and ECB) that led to a misallocation of capital, increased wealth inequality and overvaluations on the real estate markets in the 2010s.

But the SNB and the other central banks are continuing as they did during the negative interest rate phase; there is a lack of any recognition of the errors in monetary policy.

Real estate investments in Switzerland: investment returns expected to be stronger again in 2025

Despite our concerns about the SNB’s policy in the medium and long term, it is supportive for Swiss real estate values for the time being.

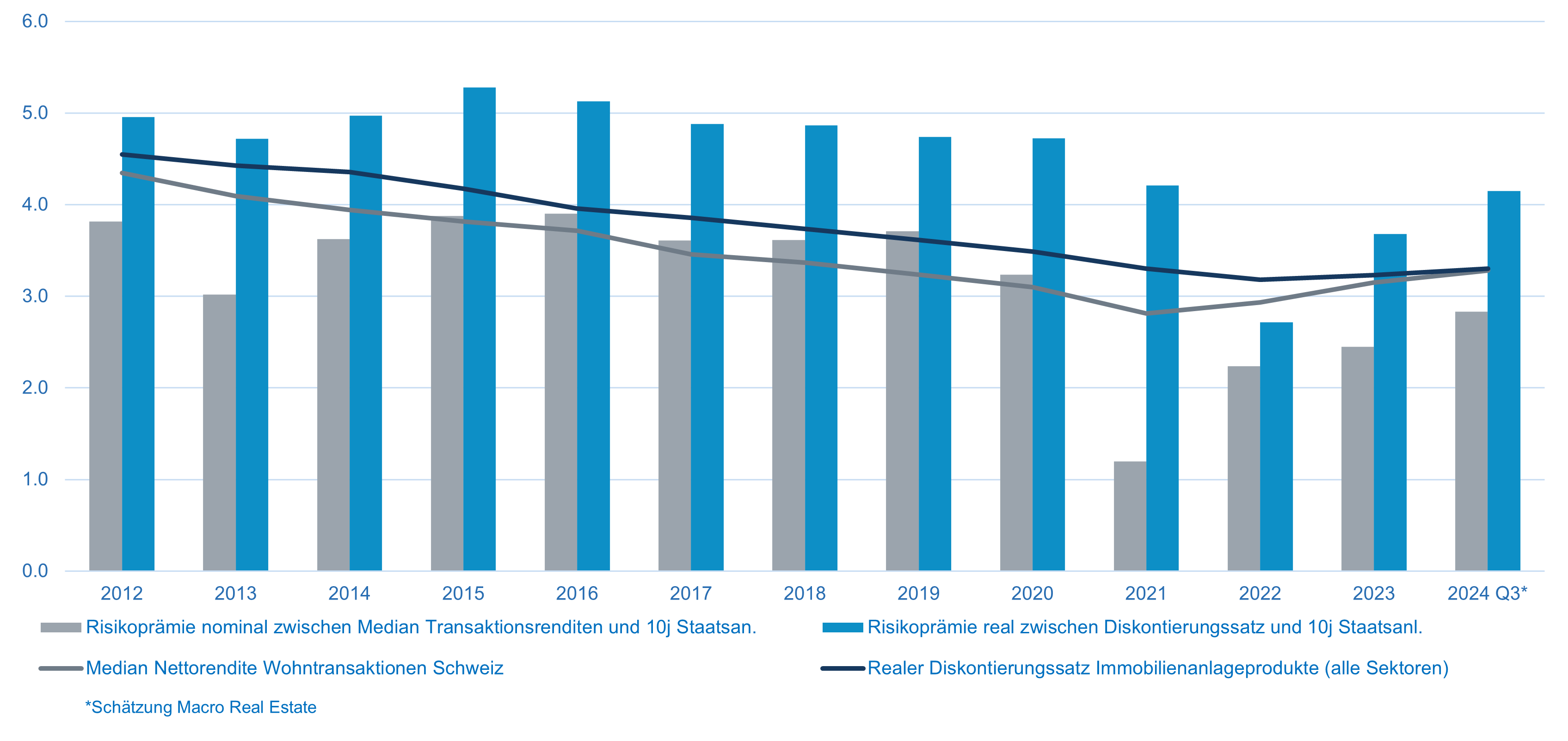

In Figure 4 we have shown the net yields on residential transactions as well as the real discount rate based on valuations. Coincidentally, the two are now on a par. Transaction yields in the residential sector (and even more so in the commercial sector) are now at slightly higher levels compared to 2021. Despite the lower interest rate level again (0.45% for 10y in Switzerland), the risk premiums based on transaction yields are currently still slightly lower than during the negative interest rate phase.

The development of the real risk premium for the discount rates is interesting. Some will remember our paper on discount rates from 2023. In mid-2023, the real risk premium vs discount rates stood at 3.1%. Today, this figure is 4.1%. In addition to a small adjustment to the real discount rates, the increase was largely due to the real interest rate, which is back at -0.85% (=0.45%-1.25%). The risk premium is therefore still too low. During the phase of negative real interest rates, the average was 4.6%. However, we do not expect them to rise further in the current environment.

Figure 4: Net yields, real discount rates and risk premiums in %

Source: Macro Real Estate, WP, UBS, annual and semi-annual reports of indirect real estate investments

In 2024 (until October), we observed stable discount rates for residential real estate, while they continued to rise slightly for commercial real estate. Overall, 2024 proved to be a transitional year for discounting and valuations. The final figures for 2024 will not be published until spring 2025. For MSCI capital value growth data, we expect an increase of 0.5 % to 1.0 % for multifamily properties and a depreciation of 1.0 % to 1.5 % for commercial properties.

However, the fall in interest rates is having a positive effect on financing. With a median net yield for apartment buildings of 3.3 % and financing costs of 1.6 %, a cash-on-cash yield of 4 % can be achieved with a loan-to-value (LTV) of 50 % and a total expense ratio (TER) of 50 basis points. This is more relevant for private investors with portfolios than for institutional products, which use significantly lower leverage ratios. Overall, the signs for real estate investments are more favorable again. The use of leverage is value accretive again.

As listed products have lost some of their potential due to the price rally (the distribution yield for popular residential real estate funds is only 2.2 %), we see 2025 as a year for NAV-based real estate products again. We forecast an appreciation of 2.5% to 3.0% for residential real estate investments in Switzerland in 2025.

As the economic situation remains fragile and commercial space in particular could suffer as a result, we continue to expect slight devaluations on average in the commercial sector. Performance here is likely to vary greatly depending on location and property quality. For central, sustainable office space, we expect an appreciation of 1.0 % to 1.5 %, while we anticipate significant devaluations of -1%–2% for non-sustainable office properties in peripheral locations or commercial space.

Overall, NAV-based real estate investments should have a good year in 2025. With distribution yields of around 3.0% for mixed vehicles, we find this asset class attractive. They could also benefit from appreciation in 2025. We recommend that institutional investors currently focus on this segment for new investments.

Listed real estate funds currently trade at an average premium of 25% over NAV and a distribution yield of 2.6%. Compared to bonds, they are fairly valued; however, we do not see any particular added value for substantial new investments in this segment, even if the general environment is likely to remain supportive in the coming months. Our focus here is on relative value and the generation of alpha through the targeted selection of individual vehicles. Should there be a further increase in premiums as part of a year-end rally, this would be a sell signal in our opinion.

International real estate investments: Attractive time to enter NAV-based vehicles

As described, listed international products have staged a fabulous rally over the last twelve months. Based on our models, many listed vehicles are now already overvalued again, particularly in the US. However, there are still opportunities to capture relative value on individual stock selection as the recovery of the real estate markets is only just beginning. If the interest rate cuts continue as expected, the rally could continue globally in a reduced form.

However, the situation for NAV-based real estate investments is completely different. We are only in the bottoming-out phase for the valuations of NAV-based vehicles. Similar to the end of the financial crisis, we now see an attractive entry window for establishing or increasing international real estate positions. The following factors speak in favor of a current entry/increase in the ratio of NAV-based vehicles:

- With a correction of around 20% since the peak, international real estate investments are one of the few asset classes that appear attractive in terms of valuation compared to equities, Swiss bonds and Swiss real estate. After a phase of very low transaction volumes, the transaction markets are slowly regaining liquidity, which opens up attractive entry opportunities. The 2023-2025 vintages for value-add funds should be particularly promising, as there are opportunities to acquire and reposition properties at a discount.

- Net initial yields are 150 to 200 basis points higher than in 2021. At these yield levels, international real estate investments would also be well positioned against a possible next wave of inflation.

- Financing costs have fallen significantly over the course of 2024 and the higher yields are once again higher than the financing costs. This should lead to a more relaxed view of refinancing issues in 2025. However, this does not apply to all players – insolvencies will continue to occur.

- We expect net initial yields to fall by 10 to 30 basis points in 2025. This means that revaluations of 3 % to 6 % could also become a reality in core portfolios. In some selected sectors, we expect double-digit total returns for 2025.

- Another positive factor is the decline in hedging costs to protect against the strength of the Swiss franc, as interest rate differentials are expected to decrease again somewhat.

However, we believe that investors must remain cautious with regard to the sector and regional mix. In an environment of weaker global economic development, we continue to recommend an overweight in structural investment themes such as logistics, residential real estate and alternative sectors. We see some potential for retail real estate again after an 8-year structural correction, especially in the USA. We continue to follow the structural trends closely and now also recommend holding around 3%-5% of a global real estate portfolio in data centers.

(Macro Real Estate’s institutional clients receive customized, detailed advice tailored to their real estate and investment portfolios)

Conclusion: Constructive outlook for the year with significant return opportunities abroad

There are still many risks, but we believe that the 2025 interest rate cycle will dominate and give real estate investments a boost again. There is no point in fighting the central banks, as they are prepared to cut their key interest rates significantly further. However, due to their short-term focus on the economy, they are underestimating the medium-term inflation risks, which we believe could materialize from 2026 on (could be also later).

Accordingly, 2025 should be a good year for real estate investments both in Switzerland and abroad. In Switzerland, we prefer NAV-based investment vehicles or vehicles that can currently buy at the higher transaction yields.

Due to the higher fluctuations in value, foreign real estate exposure must be managed more actively. There were times, such as 2006 or 2021, when it was advisable to lower the quotas and register redemptions early with real estate funds. However, we believe that we are once again in a phase in which opportunities abroad are more attractive. In Figure 5 we show that yields are just starting to turn. Traditionally, such times have always been favorable for increasing foreign real estate exposure. Now is the time for new subscriptions to international vehicles. As the rather negative experiences of some Swiss investors with some outdated products show, the construction of international real estate portfolios and the careful selection of sector and regional exposures as well as the selection of the respective vehicles is of crucial importance and can create considerable added value.

Another point in favor of international real estate investments is that focused strategies such as data centers, self-storage, last-mile logistics or alternative residential concepts are less developed in Switzerland. You need foreign real estate exposure in order to build up exposure to the structural trends that are becoming increasingly important for real estate investors. In this sense, international real estate investments are a good complement to Swiss portfolios. Swiss products are mainly invested in the traditional residential and office sectors. These are solid investments, but they lack imagination and innovation.

If you have any questions, please do not hesitate to contact us.

Figure 5: Net total returns in CHF compared to the previous year (YoY)

Quelle: Bloomberg, Macro Real Estate

Leave A Comment